Key Takeaways

- Bitcoin mining requires ASIC hardware, with efficiency (W/TH) as the critical metric for profitability

- Electricity costs represent 70-90% of operational expenses; rates above $0.10/kWh make most mining unprofitable

- Mining pools combine hashpower from thousands of miners to provide consistent payouts rather than rare jackpots

- Hosted mining offers industrial electricity rates ($0.07-$0.08/kWh) and professional operations without technical complexity

- Mining equipment qualifies for 100% bonus depreciation under current U.S. tax law, unlike spot purchases or ETFs

Bitcoin mining transforms electricity into the hardest money ever created. The process rewards participants with newly minted bitcoin for securing the network. Understanding how to start Bitcoin mining requires knowledge of hardware, hosting, pools, and economics. This guide delivers a four-step framework for investors who want exposure to bitcoin production rather than spot purchases. The key insight: mining converts a fixed electricity cost into variable bitcoin revenue. All figures and projections reflect late 2025 data.

What Is Bitcoin Mining and Why It Matters Now

Bitcoin mining is the process of validating transactions and adding new blocks to the blockchain. Miners compete to solve a cryptographic puzzle using specialized hardware. The first miner to find a valid solution wins the block reward: 3.125 BTC plus transaction fees as of early 2026.

Think of mining like a global lottery that runs every ten minutes. Your tickets are the computational guesses your hardware generates. More hashpower means more tickets. The network adjusts the puzzle difficulty every 2,016 blocks to maintain a ten-minute target.

This proof-of-work mechanism secures ~$1.8 trillion in value as of late 2025, with projections exceeding $2 trillion by 2026. It requires real-world energy expenditure to produce new bitcoin. No one can print more supply or reverse transactions without controlling 51% of the network hashrate. Mining represents the only way to acquire bitcoin without a counterparty.

How to Start Bitcoin Mining: The Four-Step Process

Step 1: Select Your Hardware

Modern Bitcoin mining requires ASICs (Application-Specific Integrated Circuits). These machines exist for one purpose: executing the SHA-256 hash algorithm. CPUs and GPUs lack the efficiency to compete.

The critical metric is efficiency: watts per terahash (W/TH). Current-generation S21-class machines operate between 13.5 and 17.5 W/TH. Older S19-class units run at 21 to 30 W/TH. A machine at 15 W/TH produces 40% more bitcoin per kilowatt-hour than one at 25 W/TH.

As of early 2026, new ASICs range from $4,000 to $12,000 per unit. Hardware prices correlate with bitcoin price and hashprice (revenue per terahash). The optimal buying window opens during miner capitulation when hashprice bottoms. This creates potential upside if you enter at cycle lows.

Step 2: Secure Hosting or Infrastructure

Electricity represents 70% to 90% of ongoing mining costs. Retail electricity rates above $0.10/kWh destroy profitability for most hardware. Professional hosting services access industrial rates between $0.07 and $0.08/kWh.

Home mining creates additional challenges: noise levels exceed 75 decibels, heat output rivals space heaters, and electrical requirements demand 220V circuits. Most residential setups lack adequate ventilation and power infrastructure.

Hosted mining eliminates these operational burdens. The hosting provider handles facility management, cooling, electrical work, and maintenance. You own the hardware. They run the operations. This structure suits investors who lack technical capability or cheap power access.

Step 3: Choose a Mining Pool

Solo mining a single ASIC could take decades to find one block. The mathematical odds make it impractical for individual machines. Mining pools solve this variance problem.

A pool combines hashpower from thousands of miners. When any member finds a block, the reward splits proportional to contributed work. You trade the chance of a large jackpot for consistent smaller payouts.

Two dominant payout structures exist. FPPS (Full Pay Per Share) pays a fixed rate for each valid share regardless of blocks found. The pool bears the variance risk and charges roughly 1% to 2% in fees. PPLNS (Pay Per Last N Shares) only pays when blocks are found. Payouts vary more but long-term returns can exceed FPPS during high-fee periods.

Most beginners prefer FPPS for its predictable income stream. Foundry USA, Antpool, and ViaBTC operate the largest FPPS pools. Ocean Pool offers a non-custodial PPLNS alternative using its TIDES system. Ocean holds ~1-2% of network hashrate. The pool remains niche but attracts miners who prioritize decentralization.

Step 4: Onboard and Operate

The final step connects your hardware to the mining ecosystem. This process involves configuring your ASIC to point at your chosen pool, linking a bitcoin wallet for payouts, and monitoring performance.

Hosted miners sign a hosting agreement and receive dashboard access. The hosting provider handles physical setup and pool configuration. Mined bitcoin flows to your wallet address. Some pools allow non-KYC acquisition since rewards come from the protocol itself.

Uptime determines returns. Every hour offline costs revenue. Professional facilities maintain 90% or higher uptime through redundant power, proactive monitoring, and on-site repair teams. Hardware failures happen. Control boards fail. Fans burn out. Fast repair turnaround minimizes lost hashrate.

Why Investors Care About Bitcoin Mining

Mining offers a different risk profile than spot bitcoin purchases. You lock in an electricity rate and produce bitcoin regardless of price. When bitcoin rises faster than difficulty, miners gain leverage. When bitcoin falls, losses get capped at operational costs plus hardware depreciation.

The tax treatment also differs. Mining equipment qualifies for 100% bonus depreciation under the 2025 OBBBA reinstatement. A $100,000 hardware purchase can offset $100,000 in taxable income the year of purchase. Spot bitcoin and ETF purchases offer no equivalent deduction. State conformity varies. Consult a tax professional for guidance specific to your situation.

What can go wrong: Difficulty spikes, bitcoin price crashes, or equipment failures can turn profitable operations negative. The April 2024 halving cut block rewards from 6.25 BTC to 3.125 BTC overnight. Miners with inefficient hardware or expensive power struggled.

Mitigation: Focus on efficiency. Run current-generation ASICs at low electricity rates. Some hosting contracts include pause periods that let you suspend operations during unprofitable conditions.

Decision Framework: Should You Mine Bitcoin?

Consider mining if you have capital to deploy for 12 or more months, access to electricity under $0.08/kWh (directly or through hosting), and conviction that bitcoin appreciates over your investment horizon.

Choose spot purchases or ETFs if you want immediate liquidity, cannot commit capital for extended periods, or prefer zero operational complexity.

The breakeven calculation is simple. Take your daily electricity cost and compare it to daily mining revenue at current hashprice. If revenue exceeds cost, you acquire bitcoin at a discount to market price. Use a mining calculator to model scenarios with different hardware and electricity rates.

If your electricity cost runs $7 per day and your miner generates $12 in bitcoin per day, you produce bitcoin at a 42% discount. That margin compresses or expands with network difficulty and bitcoin price.

Comparing Your Options: Home vs. Hosted vs. Cloud

Home mining offers full control but demands technical skill and cheap residential power (rare). Expect 75+ dB noise, significant heat output, and potential electrical upgrades. Best for hobbyists or those with unique power situations.

Hosted mining balances control with convenience. You own the hardware while professionals handle operations. Electricity rates of $0.07 to $0.08/kWh beat most retail options. Contracts run 12 months. Best for investors seeking production exposure without operational burden.

Cloud mining involves renting hashpower from a third party. You never own hardware. Counterparty risk runs high: many cloud mining operations have collapsed or turned fraudulent. Payouts depend on contract terms that often favor the provider. Most experienced miners avoid cloud contracts.

For investors deploying $25,000 or more, hosted mining offers the best balance of control, cost, and convenience.

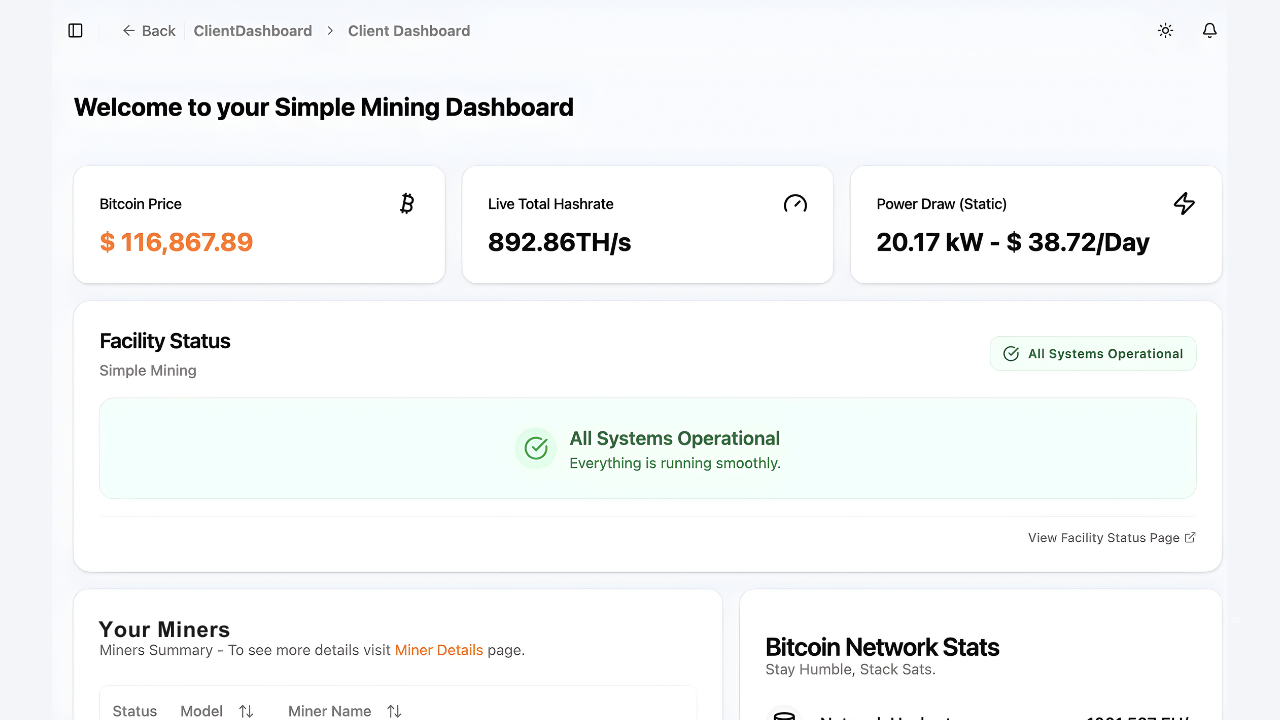

The Simple Mining Approach

Simple Mining operates over 20,000 ASICs for 1000+ clients around the globe. The all-in electricity rate runs $0.07 to $0.08/kWh with a ~65% renewable energy mix.

The operation includes 12 months of free repairs with on-site technicians. Hardware failures get addressed within one to two weeks. Precision billing charges for actual consumption. No estimates or hidden fees.

New clients can test the experience with a 7-day free miner trial. The company sources current-generation ASICs for purchase and bundles them with hosting for turnkey deployment. Clients choose their own mining pool and receive direct payouts to their wallet.

For those serious about mining versus buying bitcoin, the math depends on timing, hardware selection, and electricity cost. Simple Mining provides the infrastructure to run the numbers with real operations rather than theoretical models.

Conclusion

Learning how to start Bitcoin mining comes down to four decisions: hardware, hosting, pool, and commitment. Efficiency wins over raw hashpower. Cheap electricity beats expensive hardware. Uptime determines actual returns.

Mining converts electricity into bitcoin at a cost you control.

Ready to see the economics for your situation? Start a 7-day free trial and mine with real hardware before committing capital.