Key Takeaways

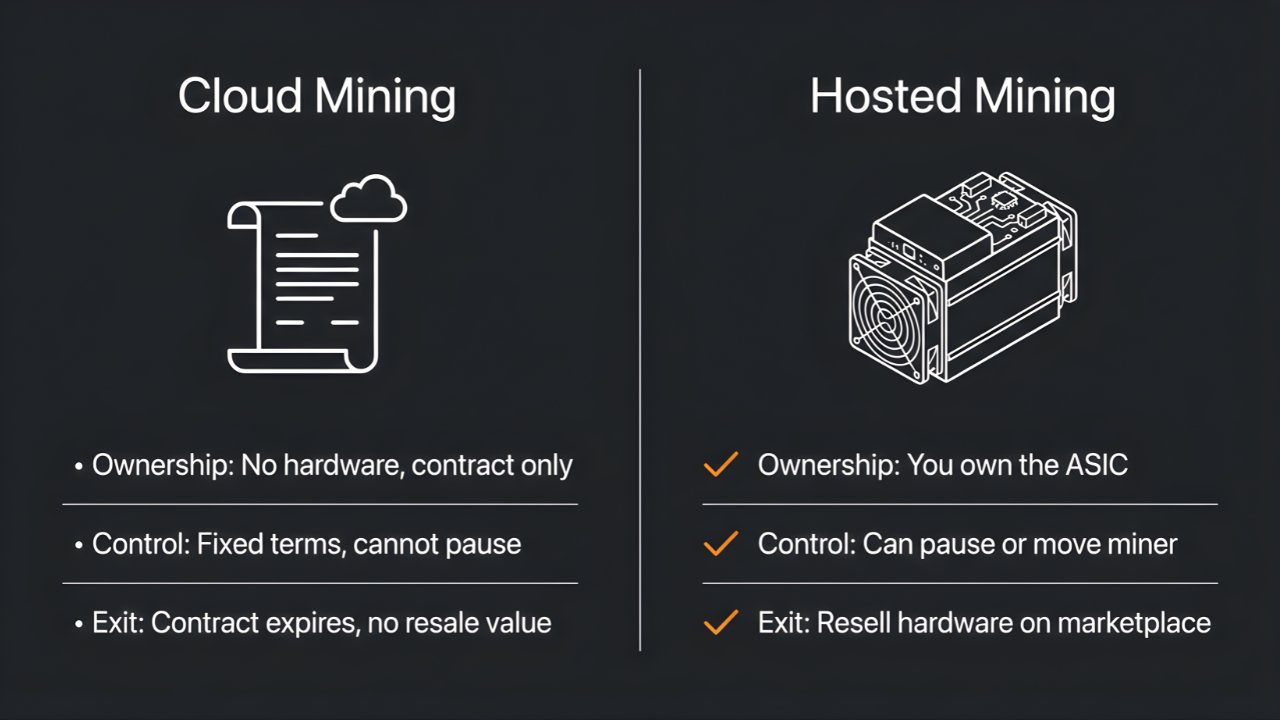

- Cloud mining sells hashrate contracts with no hardware ownership; hosted mining gives you a physical ASIC in your name

- Owned mining equipment acquired after January 19, 2025, qualifies for 100% bonus depreciation under the OBBB; cloud contracts receive no accelerated tax benefit

- Most retail cloud-mining contracts have little secondary market and cannot easily be sold; hosted miners can be paused, resold, or shipped elsewhere

- Multiple cloud mining operations have been exposed as frauds; hosted mining carries lower counterparty risk because you own the asset

- The ownership test: if you cannot take delivery of the machine or sell it on a secondary market, you face risks that ownership eliminates

The question of cloud mining vs hosting comes down to one thing: ownership. Cloud mining sells you a contract for hashrate you never touch. Hosted mining puts a physical ASIC in your name at a professional facility. One model gives you a receipt. The other gives you a machine.

This distinction matters because Bitcoin mining is capital-intensive. The asset you control determines your risk profile, tax treatment, and exit options. If you want exposure to Bitcoin mining without running equipment at home, you need to understand what you own in each model.

What Is Cloud Mining vs Hosted Mining?

Cloud mining is a service where you pay for a share of hashrate from a remote facility. You purchase a contract for a specific amount of computational power (measured in terahashes per second). You never see the hardware. You receive Bitcoin payouts minus fees for a fixed contract duration.

Think of cloud mining like buying a timeshare. You pay for access to something you never own. When the contract expires, you leave with nothing but the payouts you received.

Hosted mining works the opposite way. You purchase an ASIC miner and pay a hosting company to operate it. The machine sits in their data center. They manage power, cooling, security, and maintenance. You own the hardware outright. Bitcoin flows from the mining pool to your wallet. The arrangement is like owning a rental property and paying a property manager.

The technical difference is straightforward. In cloud mining, the provider owns the hashrate and allocates portions via contract. In hosted mining, you own a specific machine that produces specific hashrate. Your serial number. Your output. Your asset.

How Each Model Works

Cloud Mining Process:

You select a hashrate package from a provider website. Common offerings range from 10 TH/s to 1,000 TH/s. You pay an upfront fee plus ongoing maintenance charges. The provider credits your account with Bitcoin based on contract terms. Contracts run 12 to 36 months.

Example: A 100 TH/s contract costs $2,000 upfront with $0.10/TH/s daily maintenance. At December 2025 hashprice levels (~$38–40/PH/s/day), a 100 TH/s contract generates roughly $3.80–$4.00 per day before fees. With typical 2025 maintenance fees of $0.09–$0.12 per TH/s per day, most 100 TH/s cloud contracts are deeply unprofitable (often losing $4–$7 per day).

Hosted Mining Process:

You purchase an ASIC miner. Current-generation machines like the Antminer S21 XP (270 TH/s) typically cost $4,300–$6,000 in late 2025. You ship the machine to a hosting facility or purchase through a turnkey provider. The host connects your machine, handles operations, and charges a per-kilowatt-hour fee.

Example: An S21 XP consumes 3.6 kW. At $0.08/kWh all-in hosting, your monthly electricity cost is $210. The machine generates around $10.50/day in Bitcoin revenue at December 2025 conditions. Your monthly profit before CAPEX recovery is approximately $105.

The math shows hosted mining produces variable returns based on real mining economics. Cloud mining produces fixed deductions regardless of market conditions.

Why Investors Care About Cloud Mining vs Hosting

Ownership creates three critical differences for investors.

Tax Treatment: Under the OBBBA, owned mining equipment acquired qualifies for 100% bonus depreciation. A $50,000 ASIC purchase can reduce taxable income by the full $50,000 in year one. Cloud mining contract fees remain ordinary deductible expenses with no accelerated benefit.

Counterparty Risk: Cloud mining requires trust in an opaque operator. You cannot verify the hardware exists. You cannot audit uptime. You cannot confirm they mine at all. Several cloud mining operations have been exposed as Ponzi schemes. HashOcean, Mining Max, and BitClub Network defrauded investors of hundreds of millions.

Hosted mining carries counterparty risk too. But you own a physical asset with a serial number. If the host fails, you can ship your machine elsewhere. The hardware remains yours through any business disruption.

Exit Options: Most retail cloud-mining contracts have little to no secondary market and cannot easily be sold or transferred. When conditions turn unfavorable, you wait for the contract to expire.

Owned ASICs trade on active secondary markets. Providers like Simple Mining operate miner marketplaces where clients buy and sell machines. Hardware retains value. You can exit your position when strategy demands.

What Can Go Wrong: Cloud mining contracts often become unprofitable when network difficulty rises. The fixed maintenance fees consume all revenue. You cannot pause the contract. You cannot adjust your position. You watch the losses accumulate.

Mitigation: Hosted mining offers pause periods. When hashprice drops below breakeven, you stop the machine. No electricity charges accrue. You preserve capital and wait for better conditions.

Decision Framework: Cloud Mining vs Hosting

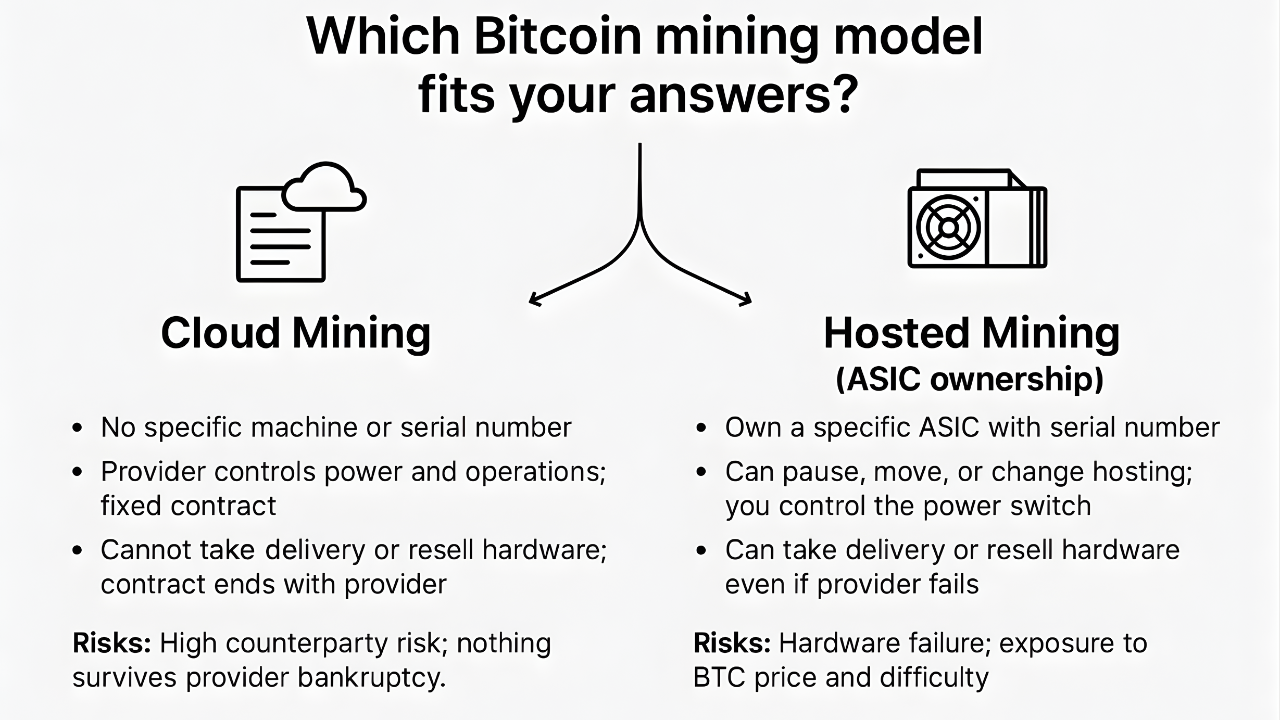

Ask these five questions before choosing a model:

1. Do I own a specific machine with a serial number? If yes: hosted mining. If no: cloud mining.

2. Who controls the power switch? If you can pause operations: hosted mining. If the provider dictates all decisions: cloud mining.

3. Are payouts variable or fixed? Variable payouts based on network conditions signal real mining. Fixed yields that look like bond coupons signal synthetic exposure or worse.

4. Can I take delivery or resell the hardware? If yes: you own something. If no: you own a promise.

5. What survives provider bankruptcy? In hosted mining, your machine ships to a new location. In cloud mining, your contract becomes a claim in bankruptcy court.

The pattern is clear. Hosted mining answers "yes" to ownership questions. Cloud mining answers "no."

Comparing the Models Side by Side

Capital Structure: Cloud mining requires lower upfront capital. A $500 contract gets you started. Hosted mining requires $3,000+ for entry-level ASICs. The difference is rent versus buy. Lower entry cost means zero equity.

Returns Profile: Cloud mining returns decline as difficulty increases. Maintenance fees remain constant while revenue falls. Most cloud mining contracts show negative returns after 12 months.

Hosted mining returns fluctuate with hashprice. When Bitcoin price rises faster than network hashrate, miners profit. The asset itself can appreciate. ASIC prices correlate with Bitcoin price over market cycles.

Operational Transparency: Cloud mining operates as a black box. You trust reported numbers. Hosted mining offers dashboard access to real-time hashrate, temperature, and pool payouts. You verify performance against pool data.

Privacy: Many cloud providers require KYC. Hosted mining can be done with or without KYC depending on the facility. Direct pool-to-wallet payouts remain possible and are generally more private than most cloud platforms.

The Simple Mining Angle

Simple Mining operates as a hosted mining provider. The model gives clients ownership while handling operational complexity.

Hardware Ownership: Clients purchase ASICs outright. The machine sits at one of our Iowa data centers with a unique identifier. Ownership transfers on purchase. The asset qualifies for bonus depreciation.

Transparent Operations: All-in hosting rates run $0.07 to $0.08 per kWh. No hidden fees. Precision billing tracks consumption to the kilowatt-hour. Clients access dashboards showing real-time hashrate and earnings.

Repair Infrastructure: Simple Mining operates North America's largest ASIC repair center on-site. Machine failures can get fixed in hours rather than weeks. The first 12 months of repairs come included. This infrastructure delivers 95%+ uptime across the fleet.

Flexibility: Pause periods let clients stop mining during unfavorable conditions. No penalty. No ongoing charges. Resume when hashprice recovers.

Liquidity: The Miner Marketplace enables secondary sales. Clients can sell machines to other investors or upgrade to newer models. Exit options exist beyond contract expiration.

Energy Mix: The Cedar Falls facility sources approximately a 65% renewable energy mix, primarily wind.

The 7-day free trial lets new clients test the model before committing capital.

Conclusion

For most retail investors in 2025, the ownership and flexibility advantages make hosted mining the superior choice. A handful of regulated cloud providers still exist, but they remain the exception.

If you cannot verify the hardware, control the operations, or sell the asset, you face risks that ownership eliminates. Real machines offer real optionality.

Ready to own your hashrate instead of rent it? Start a 7-day free trial and test hosted mining with zero commitment.