Investing Strategies for Family Offices

Institutional grade Bitcoin Mining for Family Offices. As low as $0.07 kWh all-in.

Why Now?

$12B+ ETF Inflows

Q1 2025

Strategic Bitcoin Reserve

Government Backing

SAB 121 Repeal

Regulatory Clarity

Perfect Timing

Market Opportunity

Why Simple Mining?

Trusted by over 600 clients with proven track record and institutional-grade infrastructure.

Over 600 clients and 20,000+ miners running. (Q1 2025)

Across our Bitcoin Mining Facilities.

Strategically located in Iowa.

Maintained by our clients.

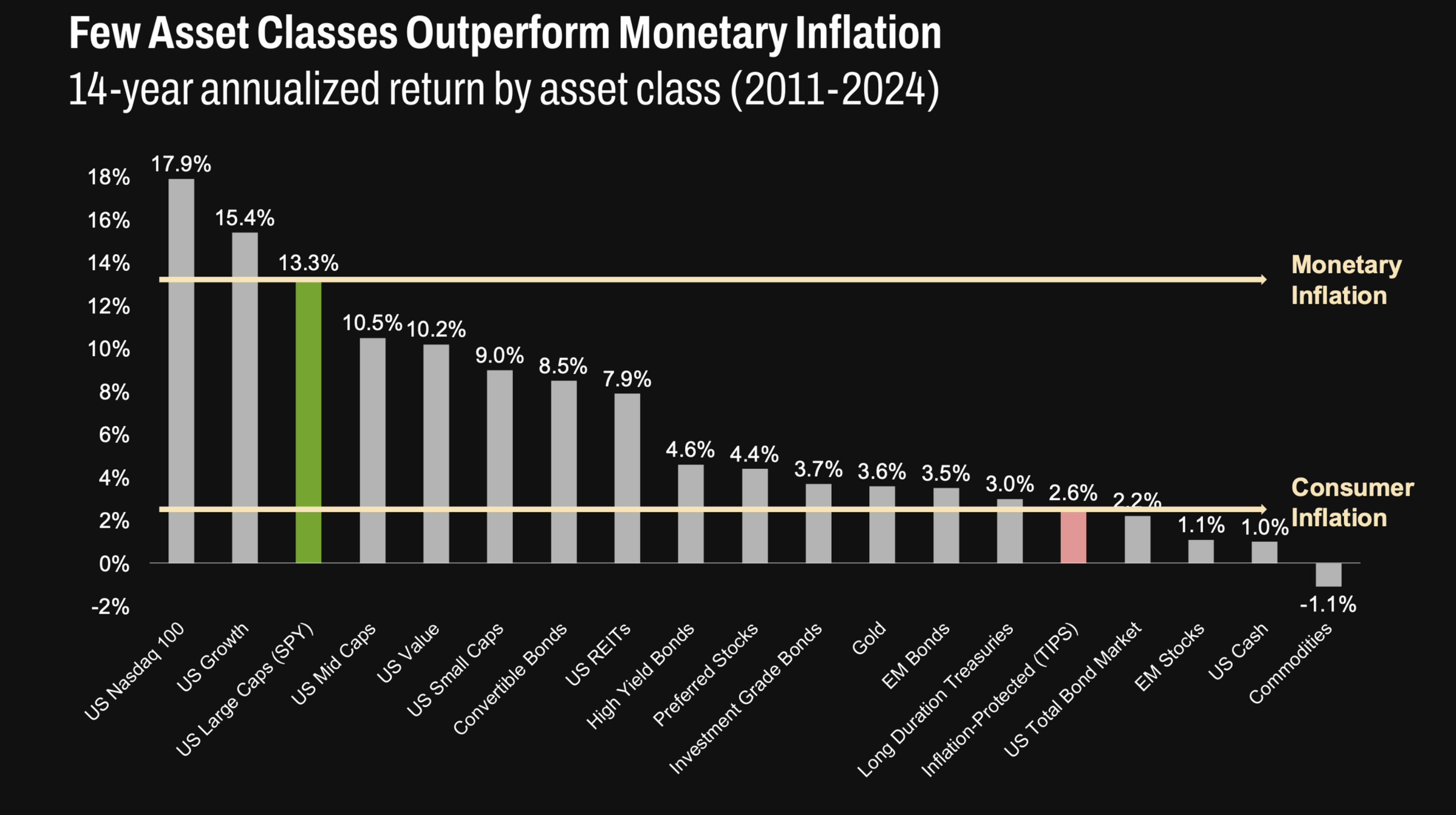

Few Asset Classes Outperform Monetary Inflation

Bitcoin has proven to be one of the strongest performing assets, outperforming traditional investments in 11 of the past 14 years.

Premium White Glove Service

End-to-end managed hosting with institutional-grade infrastructure and support

We handle infrastructure, power, contracts, security, deployment, and repair so you can focus on your investment.

#1 rated ASIC Repair center in North America, with capacity to repair over 2,000 hashboards per month.

Real-time reporting on active miners, marketplace offerings, facility status, and comprehensive analytics.

Iowa Energy Advantage

Strategic location with optimal conditions for Bitcoin mining operations

Wind and Solar Consumption

Natural cooling in summer

Stable operating environment

Low cost of power (all-in)

HF 246 support

From Pain Points to Simple Solutions

Investor Pain Points

Institutional Rates and Volatility

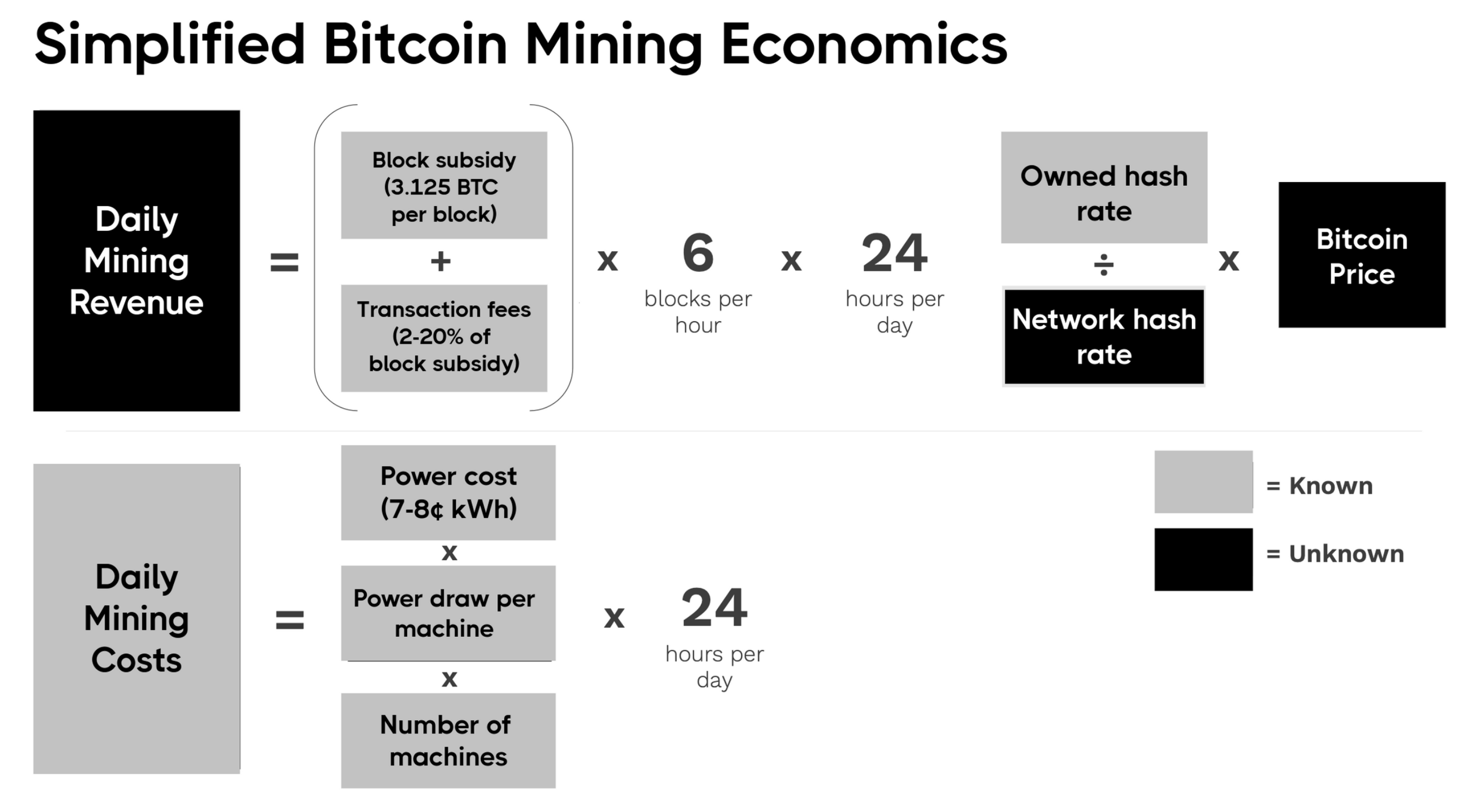

Electricity is the majority of miner OPEX and can make or break profitability.

Operational Complexity

Few family offices have the staff or desire to run a profitable industrial data-center business.

Opaque Cost Structure

Hidden charges and terms make cash-flow modeling impossible and erode trust.

Regulatory Uncertainty

Investors need clarity on entity structure, reporting, and compliance.

Simple Solutions

Long Term Fixed Contracts

Our locked in energy rates give investors clear, bankable cash-flow projections.

End-To-End Hosting

Turn-key procurement, advanced cooling, and Bitmain-certified repairs keep your ASICs hashing.

Client Dashboard

Real-time hashrate, miner marketplace, P/L analytics, and line-item billing.

Stable Regulatory Environment

US-domiciled SPV, SOC-2 controls, OFAC compliance, and CPA advisory.

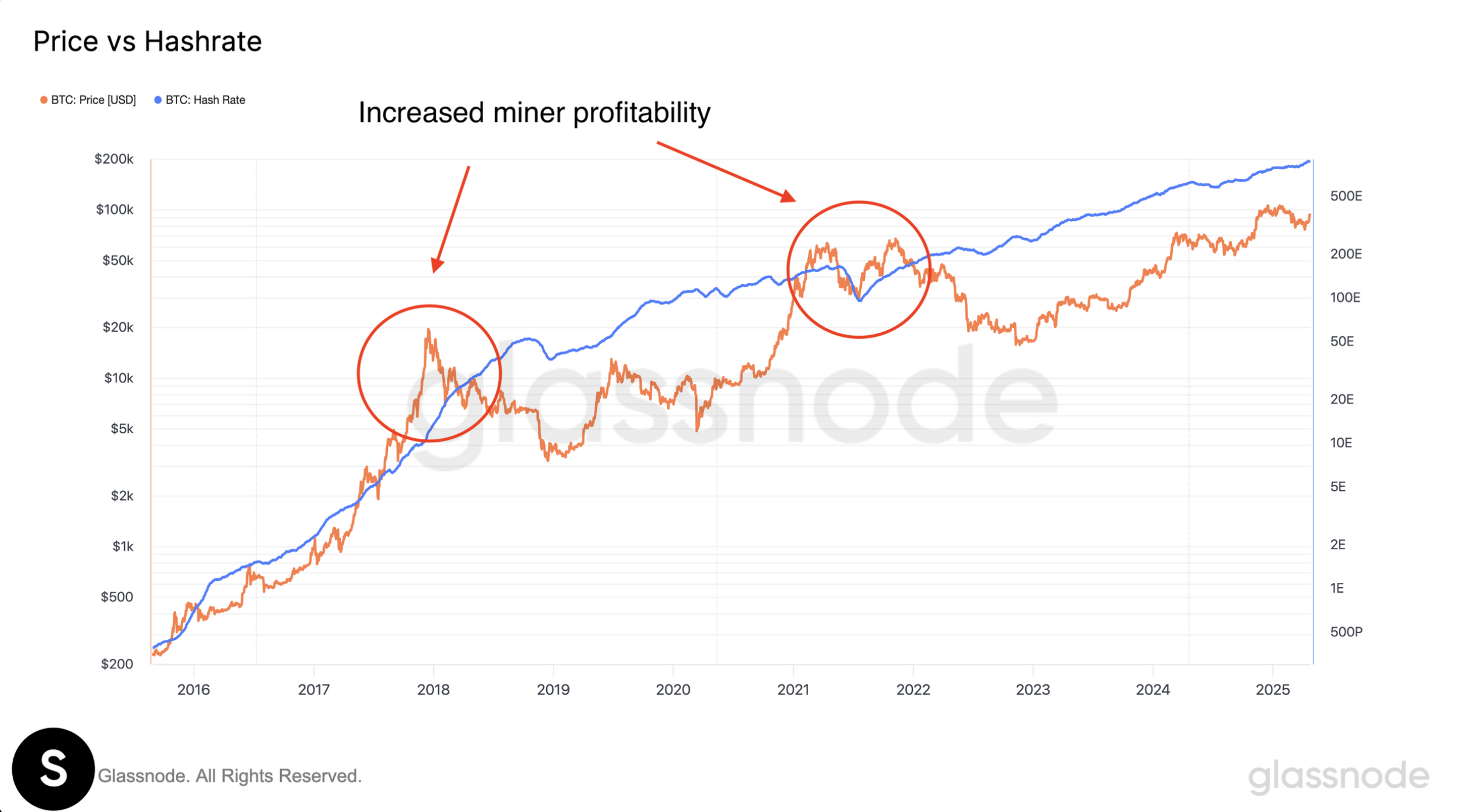

Mining is most profitable when price outpaces hashrate.

Hashrate can be viewed as the "cost" to mine.

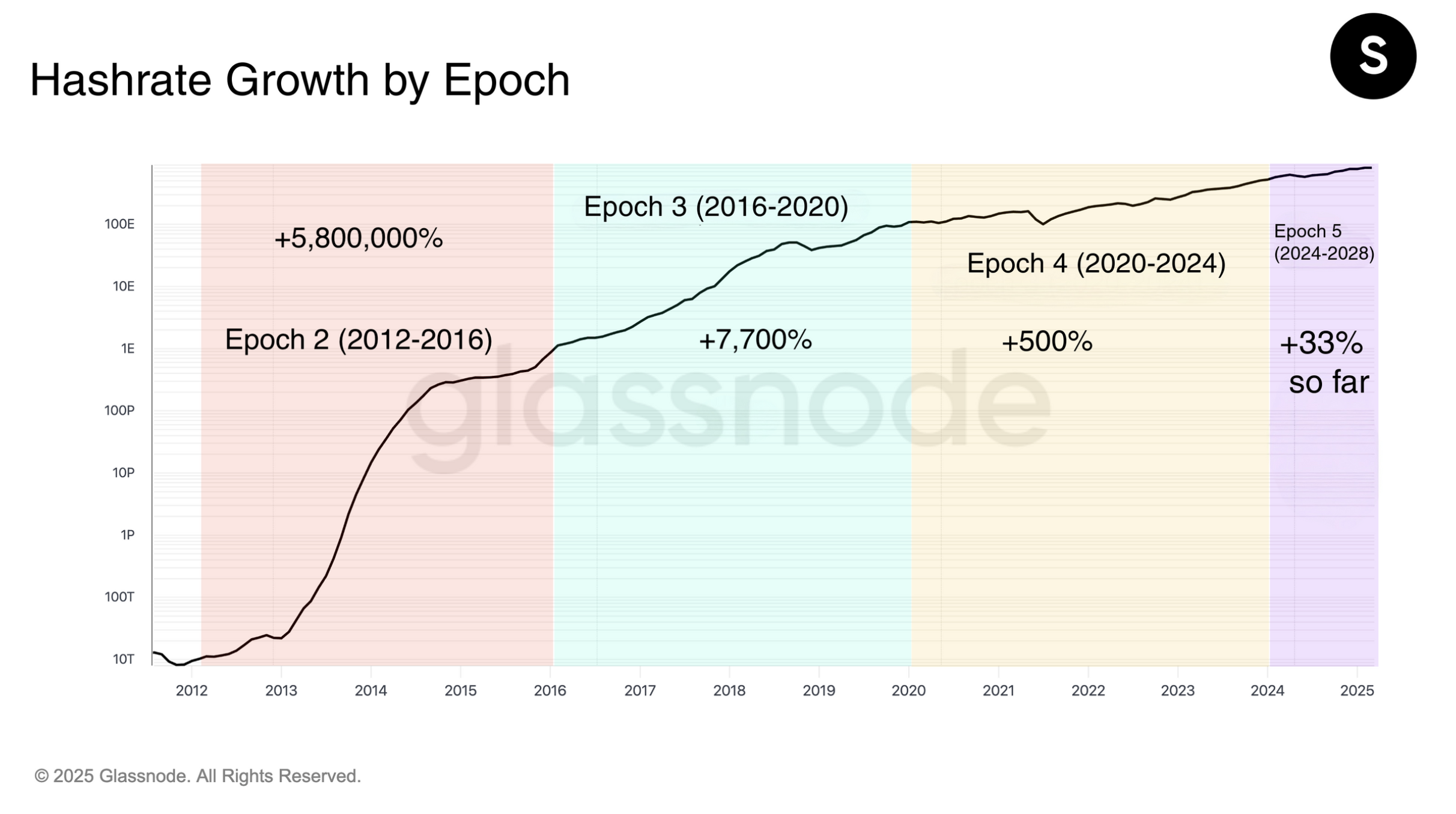

Hashrate Growth

Hashrate growth is slowing down by epoch.

Mining Economics

Miner Revenue - OPEX = Net Profit.

Explore our Miner Revenue Comparison Data

Curious about operation margins on each miner? Use our visual data to compare common Bitcoin Miners revenue and profitability.

Buy Bitcoin At A Discount

With Bitcoin Mining, you're not purchasing Bitcoin at the market rate; you're buying electricity, which is converted into Bitcoin. This can dramatically reduce your BTC acquisition cost, especially when Bitcoin prices rise sharply.

Tax Benefits

A properly structured mining operation converts electricity into tax-advantaged cashflow. Upfront expensing plus deductible power costs can lift IRR projections.

BTC earned is ordinary income on receipt, appreciation after 12 months becomes long-term capital gains.

Electricity, hosting, repairs, and insurance are ordinary business expenses - directly reduce taxable income.

Section 179 + 40% bonus depreciation (2025) lets you expense most CAPEX year 1.

Our tax partners can help our clients optimize tax calculations and maximize profitability and minimize tax burden.

Our Roadmap

Explore our journey ahead. We're committed to innovation and growth in the Bitcoin mining industry.

Q4 2021 - Energized Site #1

Initialized our infrastructure by launching our first Bitcoin mining hosting facility.

Q4 2022 - Energized Site #2

Expanded our infrastructure & capacity by launching a new Bitcoin mining hosting facility, capable of supporting an additional 5 MW.

Q2 2024 - Energized Site #3

Constructed our state-of-the-art Headquarters, while expanding our capacity by launching our third Bitcoin mining hosting facility capable of supporting 5 MW, and our repair center

Q2 2024 - Energized Site #4 & #5

Expanded our infrastructure & capacity by launching 2 new Bitcoin mining hosting facility, capable of supporting an additional 5 MW each.

Q1 2025 - 50 Megawatt Milestone

Simple Mining reaches 50MWs of power consumption, with 2.5+ EH/s of Hashrate online.

Q1 2026 - 500 MW Capacity

Simple Mining is on pace to reach 500MWs of power capacity by the end of 2026

Ready to Get Started?

Join over 500 family offices already mining Bitcoin with institutional-grade infrastructure and support.