Key Takeaways

- The Bitcoin mempool is a temporary waiting area for unconfirmed transactions on each node

- Miners select transactions from the mempool based on fee rates (sat/vbyte)

- Block space is limited to ~4 million weight units so users compete through fees during high demand

- RBF and CPFP are tools to accelerate stuck transactions

- Transaction fees can spike to 15-90% of miner revenue during bull markets and special events

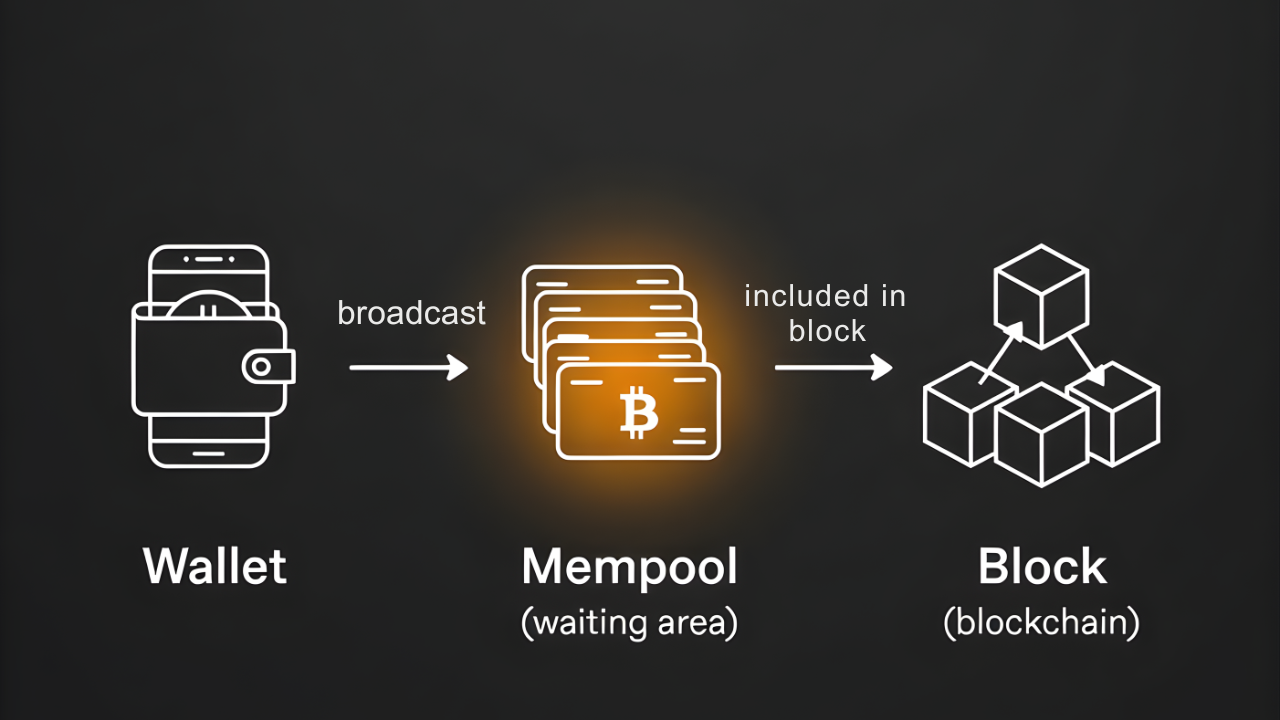

The Bitcoin mempool is the waiting room for every unconfirmed transaction on the network. When you send Bitcoin, your transaction does not go straight into a block. It sits in the mempool until a miner selects it. Understanding how this queue works gives you control over fees and confirmation times. This is essential knowledge for anyone who moves Bitcoin on-chain.

What Is the Bitcoin Mempool?

The mempool is a temporary storage area for pending Bitcoin transactions. Think of it as the lobby of a concert hall. Everyone with a ticket waits there until an usher (miner) calls their section to enter the venue (blockchain).

Each full node on the Bitcoin network maintains its own mempool. There is no single global mempool. When you broadcast a transaction from your wallet, it travels across the peer-to-peer network. Each node that receives it validates the transaction and adds it to its local mempool. This decentralized design prevents any single point of failure.

The mempool exists in a node's memory (RAM). If a node restarts, the mempool clears. Transactions that have not confirmed can be re-broadcast by wallets. This keeps pending transactions alive until miners include them in a block.

How the Bitcoin Mempool Works

The journey from your wallet to the blockchain involves several steps. Here is the process:

Step 1: Transaction Creation

You open your wallet and enter the recipient address and amount. The wallet creates a transaction and signs it with your private key.

Step 2: Broadcast to Nodes

Your wallet sends the signed transaction to connected full nodes. These nodes verify the signature and check that you have sufficient balance.

Step 3: Entry Into the Mempool

If the transaction is valid, each node adds it to its mempool. The node then relays the transaction to its peers. Within seconds, your transaction spreads across thousands of nodes.

Step 4: Miner Selection

Miners pull transactions from their mempool to build a candidate block. They prioritize transactions that pay higher fees per unit of data (sat/vbyte). A transaction paying 50 sat/vbyte gets selected before one paying 10 sat/vbyte.

Step 5: Block Inclusion

A miner finds a valid hash and broadcasts the new block. Nodes verify the block and remove its transactions from their mempools. Your transaction now has one confirmation.

Step 6: Additional Confirmations

Each subsequent block adds another confirmation. Most recipients consider 3-6 confirmations sufficient for large amounts.

Here is a simple math example. A standard Bitcoin transaction is about 250 vbytes. At 20 sat/vbyte, the fee is 5,000 sats (about $5 at $100,000/BTC). At 100 sat/vbyte during congestion, the same transaction costs 25,000 sats (about $25).

Why Investors Care About the Bitcoin Mempool

The mempool state impacts your cost to move Bitcoin. During bull markets, network activity spikes. More people want to move BTC on-chain. This creates competition for limited block space.

Bitcoin blocks are limited to about 4 million weight units (roughly 1.7-4 MB depending on transaction types) thanks to SegWit. This limits how many transactions fit in each 10-minute block. When demand exceeds capacity, the mempool grows. Users bid against each other with higher fees to get faster confirmation.

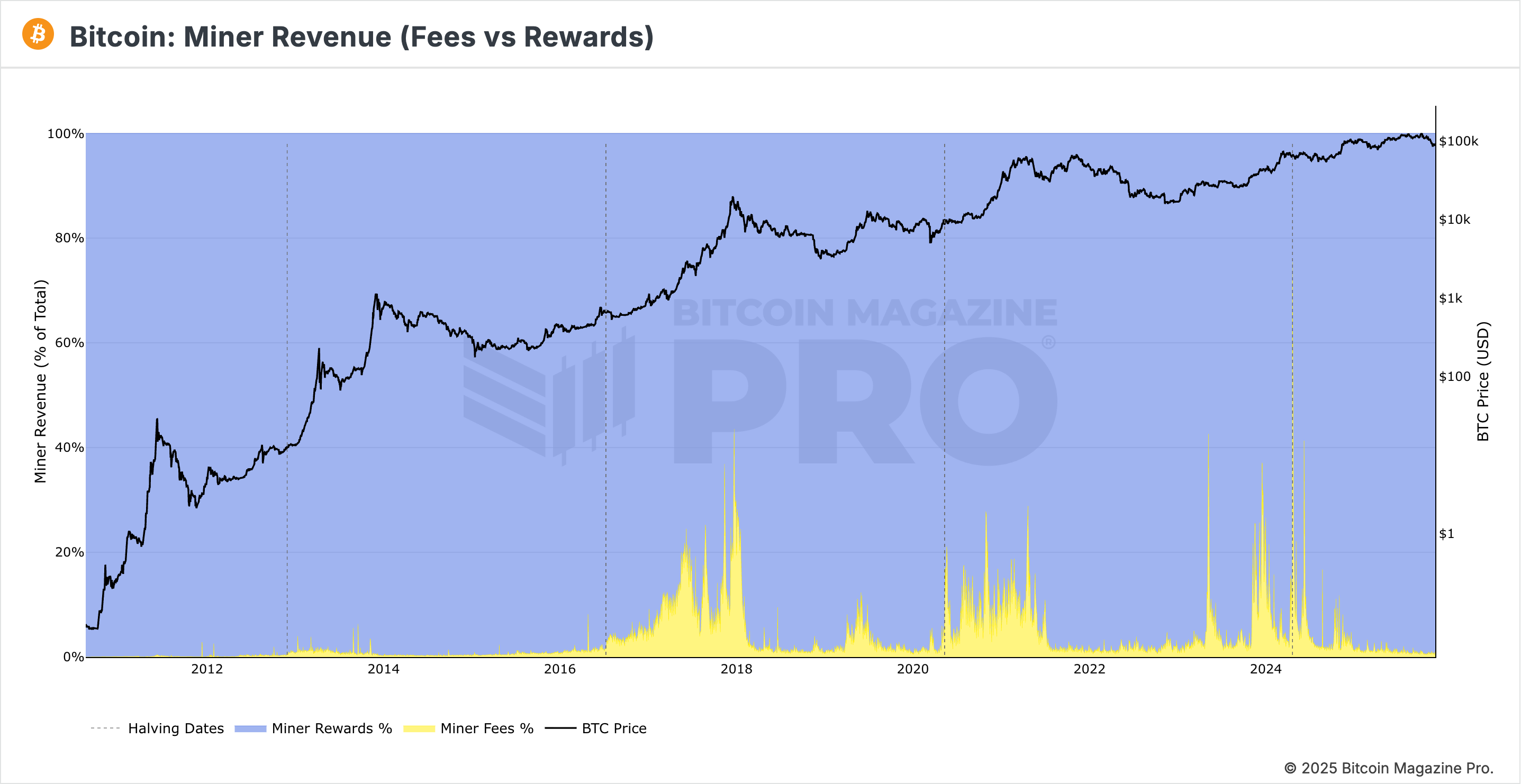

Transaction fees are a core part of miner revenue. In normal bull markets they often account for 10-20% of total income, but in extreme periods they can dominate completely.

In the weeks following the April 2024 halving, fees repeatedly surpassed 90% of the total block reward. Some individual blocks paid miners 25-40 BTC in fees alone, dwarfing the fixed 3.125 BTC subsidy and delivering total rewards up to 10-13 times the base amount.

What Can Go Wrong:

You set a low fee during sudden network congestion. Your transaction gets stuck in the mempool for hours or days. The recipient cannot access the funds until confirmation.

Mitigation:

Check mempool conditions before sending. Use a wallet that supports Replace-By-Fee (RBF). This lets you bump the fee if your transaction gets stuck. You can also use Child-Pays-For-Parent (CPFP) to accelerate confirmation.

Decision Framework: When to Pay Higher Fees

Consider these factors before choosing your fee rate:

If your transaction is time-sensitive:

Check mempool.space for current fee estimates. Pay the "high priority" rate. This targets next-block confirmation.

If you can wait several hours:

Use the "medium priority" estimate. Your transaction confirms within 3-6 blocks.

If timing does not matter:

Select the lowest fee rate your wallet offers. The transaction may sit in the mempool for a day or more during high demand.

If the mempool is clearing:

Pay the minimum relay fee (about 1 sat/vbyte). Your transaction confirms when miners need to fill blocks.

If timing does not matter:

Select the lowest fee rate your wallet offers. The transaction may sit in the mempool for a day or more during high demand.

If you are consolidating UTXOs:

Wait for low-fee periods. Batch multiple inputs into one transaction. This saves on future fees when you spend those coins.

The Mempool vs. Confirmed Blocks

| Factor | Mempool | Confirmed Block |

|---|---|---|

| Location | Node RAM | Blockchain (disk) |

| Permanence | Temporary | Immutable |

| Security | Zero confirmations | Secured by proof-of-work |

| Reversibility | Can be replaced (RBF) | Cannot be altered |

| Settlement | Pending | Final |

The mempool is not the blockchain. Transactions in the mempool have zero confirmations. They carry risk until a miner includes them in a valid block. Merchants accepting zero-confirmation payments take on reversal risk. For a deeper technical dive, Learn Me A Bitcoin covers the cryptographic details.

Once a transaction enters a block, it becomes part of the permanent record. Each additional block builds upon it. After 6 confirmations, the transaction has about 60 minutes of accumulated proof-of-work protecting it.

Why Miners Monitor the Mempool

Miners earn revenue from two sources: the block subsidy and transaction fees. The block subsidy is now 3.125 BTC after the April 2024 halving. Transaction fees add variable income on top.

How miners get paid depends on their pool structure. Full-Pay-Per-Share (FPPS) pools estimate expected fees and smooth payouts. Pay-Per-Last-N-Shares (PPLNS) pools pass through actual block rewards.

When the mempool fills with high-fee transactions, miners earn more per block. This increases hashprice (revenue per terahash). Sophisticated miners track mempool conditions to optimize their operations.

New protocols like DATUM aim to decentralize block construction. These let individual miners build their own block templates from the mempool. This reduces reliance on pool operators and combats censorship risks.

The Simple Mining Angle

At Simple Mining, we operate miners at facilities with $0.07-0.08/kWh all-in power costs. Our ~65% renewable energy mix keeps operations sustainable. We run over 20,000 ASICs for 1000+ clients across the globe.

We maintain on average 98%+ uptime through on-site repairs at our repair center. When transaction fees spike, your miners capture that upside. Our precision billing ensures you pay for what you use.

Understanding mempool dynamics helps you plan your Bitcoin strategy. High-fee environments boost mining revenue. Low-fee periods present opportunities to consolidate UTXOs or run mining profitability calculations for new hardware.

We partner with Ocean Pool and NiceHash to give clients flexibility in payout structures. You choose the pool that matches your risk preference. Our team helps match investors with the best solution for their goals.

Conclusion

The Bitcoin mempool teaches you that block space is a scarce resource with a price. Understanding this fee market makes you a more capable Bitcoin holder and potential miner.

Ready to participate in the Bitcoin fee market as a miner? Start a 7-day free trial with Simple Mining.