Key Takeaways

- Relay policy (the rules nodes use to broadcast transactions) includes standardness rules to deter spam.

- OP_RETURN limits historically managed blockchain bloat—but are now ineffective and counterproductive.

- Removing OP_RETURN limits could reduce harmful alternatives, yet concerns remain about censorship resistance and resource protection.

- Debates reflect deep cultural divides: permissionless use vs. resource stewardship; innovation vs. ossification.

If you are near the Bitcoin public square, you may have caught wind of the recent Bitcoin Core debate.

The framing conflict:

Should Bitcoin nodes actively filter non-monetary transactions (filter monkey jpeg)—or must they remain neutral relayers of any valid transaction (accept monkey jpeg).

This seems to be more of a cultural issue and less of a technical one.

Bitcoin’s promise is built on being permissionless.

Anyone, anywhere, can transact without fear of censorship.

Let’s unpack the debate clearly, with zero fluff.

Context & Definitions:

1. What is Bitcoin Core?

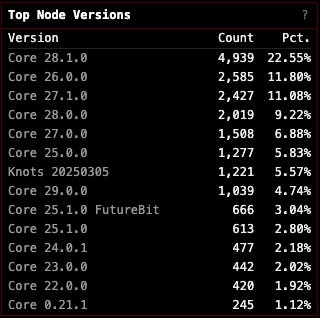

Bitcoin Core is the most widely used full-node software (~95% of nodes run Core)

The Bitcoin Core software defines the consensus rules (21 million cap by the halving, no double-spend, block validation, etc.).

A Bitcoin node is any computer or server running the Bitcoin software, enforcing the consensus rules.

With a node you can verify your own balance and the full blockchain history, rather than trusting Coinbase, Strike, etc.

You can also have “mempool control” and choose which unconfirmed transactions to relay (broadcast to other nodes to get added to chain) or reject.

Common misconception:

Core developers don’t set consensus rules; they merely implement and maintain the code.

Node runners are the ultimate authority—they can refuse to run any software not in line with the consensus.

This decentralized model is inherently messy: no single arbiter can “break up” factional fights.

2. Relay Policy & Transaction Standardness

When a Bitcoin transaction is sent, the node doesn't broadcast it instantly to everyone.

Instead, it sends it to peers who check if it follows certain rules.

Relay policy refers broadly to all rules nodes follow when interacting with other nodes on the Bitcoin network—this includes how nodes manage transactions before they're confirmed in blocks.

A key part of relay policy is transaction standardness, meaning whether transactions conform to a set of non-consensus rules that help nodes avoid unnecessary resource drain (like processing spam).

3. OP_RETURN: Bitcoin’s “Digital Sticky Note”

OP_RETURN is a special kind of Bitcoin transaction output that stores small chunks of data.

It's provably unspendable, meaning the Bitcoin sent there is burned—gone forever.

Currently, Bitcoin limits this data to about 80 bytes, discouraging excessive non-financial data storage.

OP_RETURN was introduced in Bitcoin version 0.9.0 as a compromise to allow people to include arbitrary data inside transactions.

Using the blockchain for general-purpose cloud data storage isn't ideal, but you can't stop people from doing it.

Therefore, the OP_RETURN script acts as a more reasonable alternative for data storage than previous methods.

Something I think is misunderstood, is that the OP_RETURN creates a provably-prunable output, to avoid storing arbitrary data such as images as forever-unspendable TX outputs.

This brings us to the core of the debate:

- Peter Todd’s PR

- Goal: remove the 80-byte cap, allowing unlimited arbitrary data in OP_RETURN.

Some think removing the 80-byte cap is bad.

Some think it will improve Bitcoin.

4. UTXO Set: Bitcoin’s Ledger Snapshot

Bitcoin tracks ownership via a list of unspent transaction outputs (UTXOs). Think of the UTXO set as Bitcoin’s running ledger snapshot—every transaction you make references UTXOs you own. Keeping the UTXO set small is crucial because every full node must keep it forever, making it expensive if too many useless entries pile up—this is what “bloating the UTXO set” means.

The Two Sides of the Debate:

🟢 Free Market Side: “If you pay fees, it's valid—not spam.”

Bitcoin is a money on a digital ledger and needs a database to function.

Bitcoin uses the blockchain as a database and blockspace as a means to limit the growth of that database.

Blockspace is a free market for anyone to participate in.

So what happens when someone purchases that blockspace to speculate with their money?

Can we dictate how people use their money? (Bitcoin does not rely on central planning after all)

- Main argument:

- Bitcoin is built on permissionless principles. Transactions paying valid fees, no matter their use case (even controversial data or inscriptions), should never be censored.

- Core points:

- Economic freedom: Let fees naturally price out low-value transactions.

- Practical reality: Attempts to censor through node rules rarely work—miners will always accept profitable transactions through alternate relays.

- Example: During the 2021 OFAC controversy, Marathon briefly filtered transactions from sanctioned addresses but stopped after community backlash. Most pools ignored such filters, mining those transactions anyway because they were in their mempools and offered fees.

🔴 Filtering Side: “Not all data belongs on-chain—some transactions are harmful spam.”

- Blockspace is scarce and should be reserved for monetary transactions.

- Existing OP_RETURN already gives spammers a “sandbox”—removing the limit is a slippery slope to full-blown data storage (“my node is not your Google Drive”)

- Node-runner sovereignty: Bitcoin Core’s PR would erase our ability to choose (config-option removal).

- Main argument:

- Storing arbitrary data (NFTs, JPEGs, inscriptions) on-chain increases node costs, bloats storage, and harms decentralization.

- Core points:

- Resource protection: Nodes must remain affordable to run; unnecessary data burdens decentralization.

- Active defense: Nodes independently filtering transactions are legitimate and preserve decentralization.

- Miners aren't guardians: Miners seek profits, not network health. Node-runner filtering provides a decentralized check.

- Notable advocates: Bitcoin Knots

Interesting Analogies:

- E‑mail spam folder: Nobody calls it “censorship” to filter junk mail.

- Fence Analogy: Local law says “fences are useless, someone climbed one once,” and forbids you to build a fence. That is what Core is doing to node mempools.

- Open‑borders / cultural dilution analogy: Allowing mass influx of users who don’t value sovereignty dilutes the original culture, eventually flipping priorities.

- Second‑Amendment analogy: Millions of armed citizens change incentives even if each gun can’t beat a tank. Likewise, millions of filtering nodes matter even if a miner can mine spam.

Historical Perspective (and Why It Matters):

Bitcoin has a long history of using relay policy to combat spam:

- Early Bitcoin (2010-2013): Satoshi himself introduced standardness rules to prevent network flooding.

- OP_RETURN Wars (2014): Limits set on data storage as a compromise.

- Blocksize Debates (2015-2017): Community defended small blocks to keep nodes decentralized.

- Recent controversy (2023-2025): Post-Taproot, large data inscriptions surged, reigniting debates over filtering and OP_RETURN limits.

This isn’t the first controversy over spam.

Why Lift OP_RETURN Limits Now?

Bitcoin Core developer Peter Todd proposed removing OP_RETURN limits because existing restrictions inadvertently push users towards even more damaging methods—like stuffing data into Taproot witness inputs, permanently enlarging the UTXO set with junk entries.

- Today’s reality: The OP_RETURN limit no longer effectively prevents large data storage (SegWit data embedding is already ~5000x larger).

- Example: Citrea’s Clementine bridge stored extra data using two unspendable Taproot outputs due to OP_RETURN limit—each permanently bloating the UTXO set.

Paradoxically, standardness rules intended to protect Bitcoin’s decentralization are encouraging methods that harm it more severely.

Hard Fork vs. Soft Fork (Quick Reminder):

- Soft Fork: A backward-compatible upgrade; new rules that tighten transaction validation (like adding standardness rules). Older nodes still see new transactions as valid.

- Hard Fork: A non-compatible upgrade; loosens or fundamentally changes rules, meaning all nodes must upgrade, or the blockchain splits (Bitcoin Cash is a famous example).

Bitcoin Core and Bitcoin Knots (the two sides of this debate) are not two prongs of a fork. They both agree to the same consensus rules. The difference is how the node software is managed.

Standardness changes like removing OP_RETURN limits are typically neither hard nor soft forks, but relay-policy adjustments. Still, understanding forks helps clarify the stakes of these rule changes.

Macro Tie-in: Bitcoin’s Governance and Cultural Tension

Beneath the technical arguments lies a deeper philosophical dilemma:

- Cultural sovereignty vs. Practical resource constraints

- Censorship resistance vs. Effective spam management

Bitcoin Core faces growing pains, as Bitcoin morphs from niche cypherpunk money into a global financial asset managed by diverse interests—from ETF managers to activists in Nigeria or Argentina. This raises hard questions:

- Who is Bitcoin Core really serving?

- How do we balance innovation with legacy integrity?

- Who defines what counts as spam—and what doesn't?

Bitcoin’s current "volunteer firefighter" model (small, underfunded dev teams voluntarily maintaining critical infrastructure) is under massive stress. The OP_RETURN debate is just one symptom of deeper governance challenges.

What Bitcoin Mining Investors Should Do Now

What should you, as an investor, actually do about this?

- Stay Educated: Recognize debates like this contribute to Bitcoin’s fundamental identity (not kill Bitcoin).

- Become an Intermediary: Run a node (Bitcoin Core or Bitcoin Knots) and understand the policies it enforces. Run a miner and create your own block templates.

- Follow Developments: Monitor closely how Bitcoin Core resolves these issues. Major policy shifts can significantly impact usability, fees, and network health.

- Think Critically: Resist oversimplified narratives of “Bitcoin Core compromised” or “Bitcoin’s dying.” These are nuanced debates—Bitcoin’s resilience depends on informed discourse.

Final Thoughts

Bitcoin’s greatest strength—peer-to-peer hard money you can send without needing permission from a central 3rd party —is also its most challenging feature.

But debates like these are healthy; they prove Bitcoin is monetary policy dictated by the people, not the Federal Reserve.

After all:

In Bitcoin, controversy isn’t a sign of failure—it’s proof that decentralization works.