Bitcoin either earns a place in your portfolio or it doesn’t.

There’s little room in between. The signal is clear once you understand how it behaves, where it fits, and how investors use it.

This piece breaks down how to think about bitcoin as an investment.

We’ll cover its track record, what drives price, key risks, and how professionals gain exposure today, with better capital efficiency than buying spot.

First Principles: What Are You Actually Buying?

Bitcoin is not a company, cashflow stream, or commodity. It’s a bearer asset and monetary network. What you’re buying is digital property with hard-coded scarcity and 24/7 liquidity.

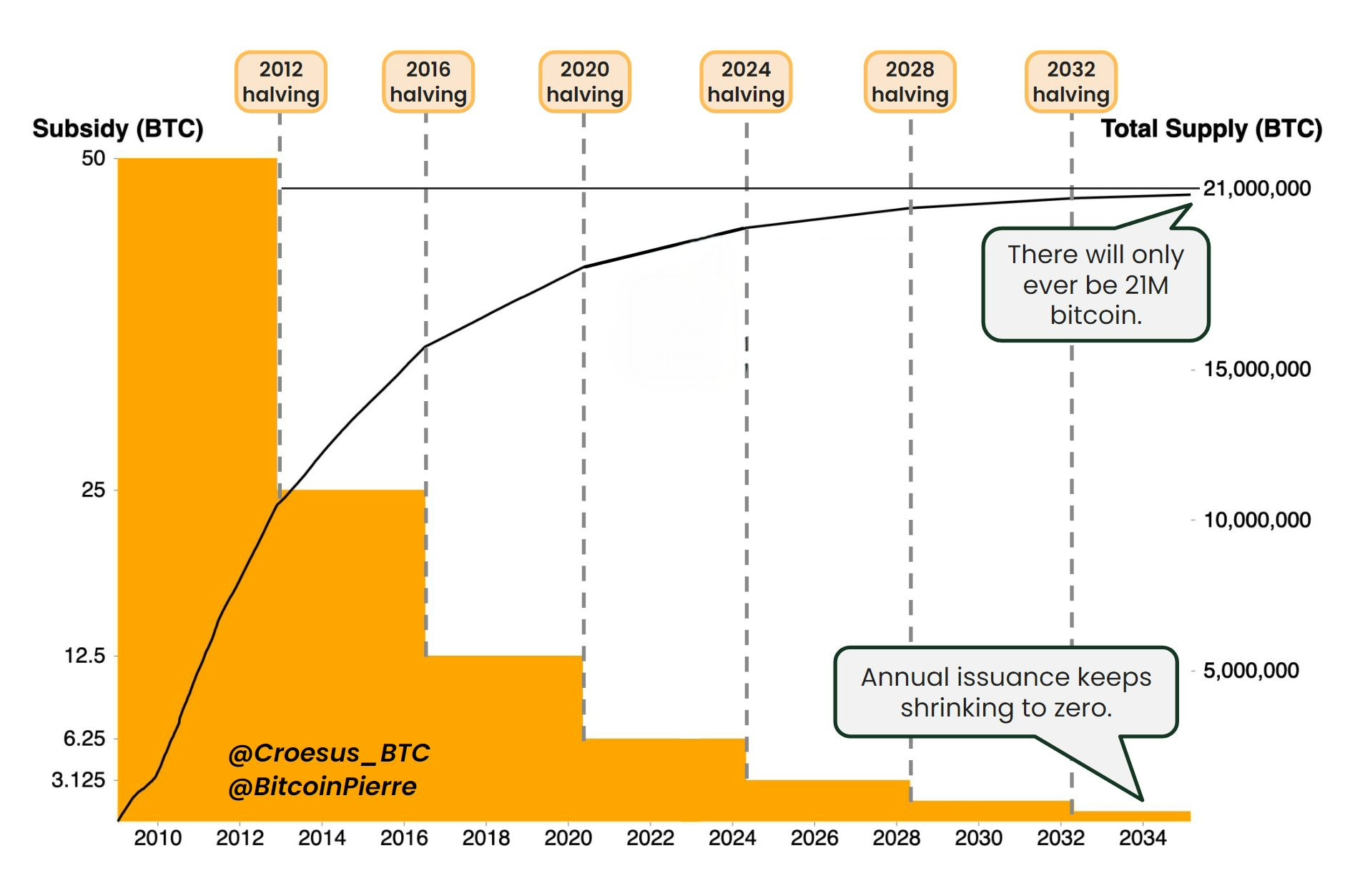

There are only 21 million Bitcoin.

That’s not a slogan. It’s enforced by thousands of independent nodes and over a decade of adversarial uptime.

There is no CEO. No dilution risk. No discretionary monetary policy. Bitcoin is the first asset in human history with perfectly known terminal supply.

That’s the foundation of its investment thesis.

Bitcoin Returns vs Traditional Assets

Since inception, Bitcoin is the best-performing asset globally. But that includes a short window (2009–2021) with asymmetrically high upside and limited institutional access. The question now is whether bitcoin offers forward-looking risk-adjusted returns attractive to serious allocators.

Here’s the case:

- Low correlation to equities and bonds

Over the past five years, BTC has shown <0.2 correlation with U.S. stocks and near-zero correlation with bonds. It doesn’t always act like a risk-off asset, but it doesn’t move in lockstep with macro either. That’s useful for diversification. - Structural supply constraint

Every four years, Bitcoin’s issuance rate halves. Unlike gold or real estate, supply cannot increase with demand. The 2024 halving dropped new issuance from 900 to 450 BTC/day. This constraint is mechanical. - Censorship-resistant global demand

Bitcoin is bought in Nigeria, Turkey, Argentina, and Silicon Valley for entirely different reasons. But the result is the same: demand grows while supply shrinks. - Liquidity and price discovery

Bitcoin trades on liquid spot and derivatives markets 24/7, with public order books and deep liquidity. That transparency is rare.

Past performance isn’t a guarantee, but price tracks fundamentals. And Bitcoin’s fundamentals are about as predictable as any monetary asset can be.

Bitcoin Risk: Volatility, Regulation, and Custody

Allocators ask two things: how volatile is this? and what are the worst-case scenarios?

Let’s address both.

- Volatility is a feature, not a bug

Bitcoin is young, thinly held, and globally distributed. Volatility is the price of early adoption. Since 2012, it’s dropped steadily—still higher than gold or equities, but compressing as adoption grows. Most allocators solve this by sizing position exposure carefully (0.5–5%). - Regulatory overhang is real but priced in

The U.S. treats bitcoin as property. ETFs are approved. Custody rails are maturing. The biggest legal risks today lie with offshore tokens, not bitcoin. That said, miners and custodians must stay nimble on jurisdictional risk. This is one reason professionalized mining infrastructure matters. - Custody failure is the new counterparty risk

You don’t own your bitcoin unless you hold your own keys. Self-custody solves this, but it's operationally intensive for some investors. Hosted mining offers a workaround: you acquire BTC directly from block rewards, bypassing exchanges.

Why Buy Bitcoin When You Can Earn It?

Buying spot BTC is easy. But for many investors, it’s not optimal.

Instead of competing for liquidity on exchanges, serious allocators increasingly acquire bitcoin through hosted mining.

It’s a capital-efficient way to dollar-cost average into BTC at production cost, while maintaining operational leverage, tax efficiency, and physical exposure.

Why Hosted Mining Makes Sense for Investors

- Production cost as a soft floor

Over time, price tends to stay above average production cost. Mining lets you acquire BTC at that cost basis without needing to time the market. - No KYC friction or custodial trust

Mined bitcoin goes directly to your wallet. You don’t need to trust an exchange and pay hefty fees. - Cashflow or accumulation

Hosted mining can be run as a yield strategy (sell BTC monthly) or accumulation strategy (HODL). Either way, you're acquiring hard assets with real uptime and physical infrastructure behind them. - Better tax treatment in the U.S.

Bitcoin mining hardware qualifies for 100% bonus depreciation under Section 179 and The One Big Beautiful Bill. By mining Bitcoin, you can reduce your overall tax burden.

Simple Mining specializes in turnkey hosted Bitcoin mining for capital allocators: professionally managed sites, precision billing, on-site repairs, and a 7-day trial to test uptime and output before you commit.

This isn’t speculation. It’s infrastructure-backed BTC acquisition with transparent economics.

How to Size a Bitcoin Investment

Bitcoin doesn’t need to be your biggest position. But it deserves a seat at the table.

Here’s how many professionals approach sizing:

- 0.5–1% for hedging tail risk

A small position with high convexity in case fiat fails or inflation accelerates. - 2–5% for asymmetric return

Enough to matter if bitcoin appreciates, small enough to stomach drawdowns. - 10%+ for conviction-based portfolios

Often structured through mining, trusts, or custody integrations for tax and operational control.

There’s no “correct” allocation, but high volatility demands discipline. If you mine, you’re averaging in over time at production cost and less exposed to market timing.

TL;DR: Is Bitcoin a Good Investment?

If you want long-term exposure to a credibly scarce, politically neutral monetary asset that operates outside the legacy financial system, the answer is yes: Bitcoin is not just a good investment, it's the only one with fixed supply, global liquidity, and a predictable issuance schedule.

Serious investors are no longer asking if they should own bitcoin. They’re asking how to own it intelligently.

Buying is one path. Earning through mining is better.

Next Step: Try Hosted Mining With No Commitment

Simple Mining offers a 7-day mining trial so you can see real uptime, output, and economics before you deploy capital.

- Miners hosted in premium U.S. facilities

- On-site repair teams

- Precision billing tied to actual performance

- ~65% renewable energy mix

- BTC paid direct to your wallet

If you're ready to invest in Bitcoin with discipline, hosted mining is worth exposure in your portfolio.