Key Takeaways

- Bitcoin mining validates transactions through computational proof-of-work, with miners competing to find valid hashes that meet the network's difficulty target

- Miners earn 3.125 BTC per block (plus fees) as of late 2025, with rewards halving about every four years until total supply reaches 21 million

- Mining profitability depends on four variables: electricity cost, hardware efficiency, Bitcoin price, and network difficulty

- Mining pools aggregate hashrate from many miners to reduce payout variance, distributing rewards in proportion to contributed work

- Professional hosting removes operational complexity while investors retain hardware ownership and direct Bitcoin payouts to personal wallets

Bitcoin mining transforms electricity into the hardest money ever created. The process secures the network and produces new Bitcoin through computational work that cannot be faked or shortcut. For investors considering hosted mining, understanding how Bitcoin mining works reveals why it functions as both a production method and a compelling alternative asset allocation.

The mining process anchors Bitcoin's value in physical reality. Energy expended today becomes digital scarcity tomorrow. This guide breaks down the mechanics so you can evaluate mining as an investment with clear eyes.

What Is Bitcoin Mining? Definition and Context

Bitcoin mining is the process of validating transactions and adding new blocks to the Bitcoin blockchain. Think of it as a global competition where specialized computers race to solve a mathematical puzzle. The winner earns the right to record the latest batch of transactions and receives newly minted Bitcoin as payment.

The analogy works like a lottery with trillions of tickets. Each guess represents one ticket. More computing power means more guesses per second. The prize goes to whoever finds the winning number first.

Bitcoin uses a consensus mechanism called Proof-of-Work (PoW). This system requires miners to prove they expended computational effort before the network accepts their block. PoW creates digital scarcity by demanding real-world resources. No one can print Bitcoin without paying the electricity bill.

How Bitcoin Mining Works Step by Step

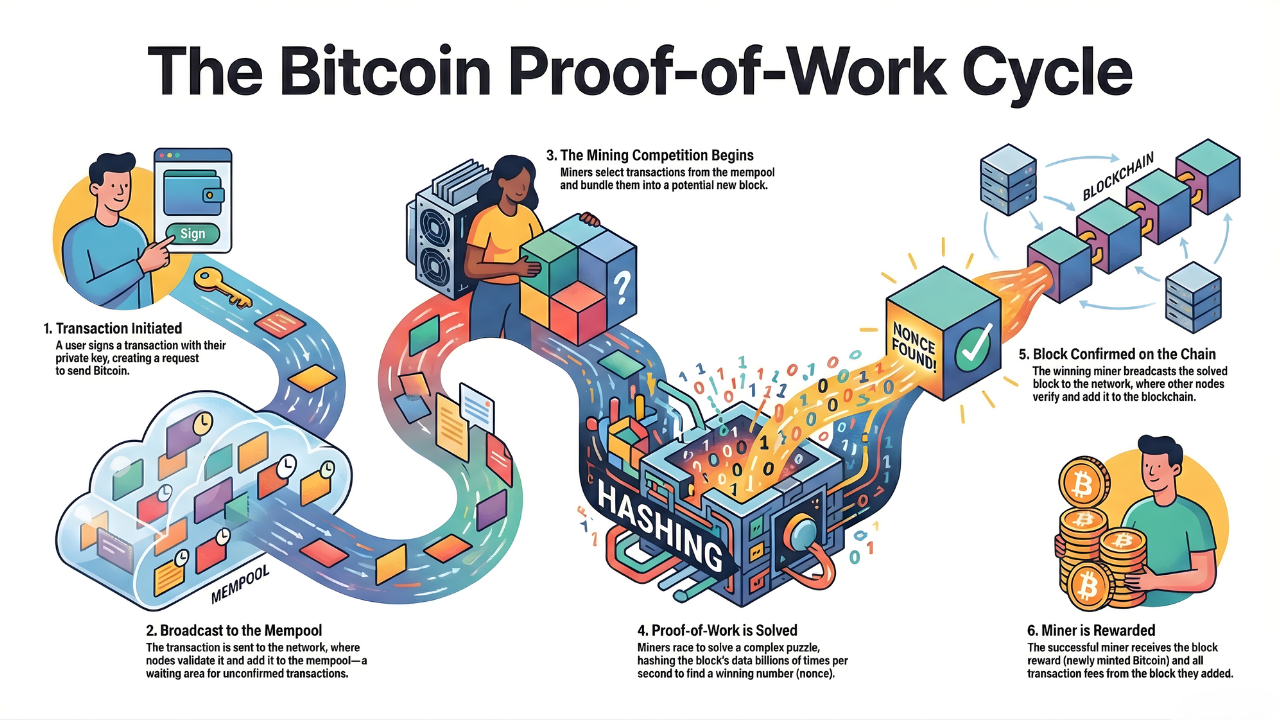

Understanding how does bitcoin mining work requires following a transaction from broadcast to confirmation. The process runs without pause across thousands of machines worldwide.

Step 1: Transaction Broadcasting. When someone sends Bitcoin, the transaction broadcasts to the network. It enters the mempool, a waiting area for unconfirmed transactions. Miners monitor this pool and select transactions to include in their proposed block.

Step 2: Block Assembly. The miner bundles transactions into a block candidate. Each block contains a header with specific data: the previous block's hash and a timestamp plus the Merkle root of transactions and a variable number called the nonce.

Step 3: The Hashing Race. Miners run the block header through the SHA-256 algorithm, producing a 64-character hash output. The goal is finding a hash that falls below the network's difficulty target. This target determines how many leading zeros the valid hash must contain.

Step 4: Nonce Iteration. Since hash outputs appear random, miners cannot predict which input produces a valid hash. They increment the nonce and hash again. Modern ASICs perform trillions of these guesses per second.

Step 5: Block Validation. The first miner to find a valid hash broadcasts the solution. Other nodes verify the hash is correct and the block follows consensus rules. Upon verification, the block joins the blockchain.

Step 6: Reward Distribution. The winning miner receives the block reward: newly minted Bitcoin plus transaction fees. As of late 2025, the block subsidy is 3.125 BTC per block following the April 2024 halving.

Here is a simple example. Imagine the target requires a hash starting with four zeros. A miner tries nonce 1 and gets hash "7a3f2b...". Invalid. Tries nonce 2 and gets "e91c8d...". Invalid. After billions of attempts, nonce 847,293,741 produces "0000a8f7...". Valid. Block confirmed.

Why Bitcoin Mining Matters to Investors

Mining creates Bitcoin at a cost basis below market price when operated well. This spread between production cost and spot price represents the core economics driving mining investment. Investors access discounted Bitcoin acquisition through converting electricity rather than purchasing at exchange rates.

The math favors miners when hashprice exceeds operating costs. Hashprice measures revenue per unit of hashrate per day. As of December 2025, hashprice sits near $35 per PH/s per day. This represents near five-year lows. Hashprice fluctuates daily based on network difficulty and Bitcoin spot price. Figures used here reflect December 2025 averages. Low hashprice periods offer attractive entry points because hardware prices correlate with hashprice.

Four factors determine mining profitability: electricity rates and hardware efficiency on the cost side; Bitcoin price and network difficulty on the revenue side. An Antminer S21 XP operating at 270 TH/s with 13.5 W/TH efficiency costs approximately $7 per day in electricity at $0.08/kWh. At current hashprice, it generates roughly $9.85 daily in Bitcoin revenue.

What can go wrong: Difficulty increases erode profitability over time. The network adjusts difficulty every 2,016 blocks to maintain ten-minute block intervals. When hashrate grows faster than Bitcoin price appreciation, margins compress.

Mitigation: Investing in high-efficiency hardware (sub-15 W/TH) provides margin protection. These machines remain profitable through deeper downturns. Older equipment with 25+ W/TH efficiency often operates at a loss during hashprice compression.

Decision Framework: Should You Mine Bitcoin?

Not every investor should mine. The decision depends on capital, time horizon, and operational preferences. Use this framework to evaluate your situation.

Consider mining if: You have $25,000+ to deploy. You seek tax advantages through equipment depreciation. You want non-KYC Bitcoin acquisition. You hold a multi-year time horizon. You prefer production economics over spot price speculation.

Consider spot buying if: You have under $10,000 to allocate. You need immediate liquidity. You want zero operational complexity. You plan to hold less than two years.

Key questions to answer: What is your all-in electricity rate? Professional hosting ranges from $0.07 to $0.10 per kWh. Home mining often exceeds $0.12 per kWh. Can you secure current-generation hardware? Efficiency determines survival through bear markets. Do you have repair access? Downtime kills returns.

Hardware selection requires balancing purchase price against efficiency. A $3,800 Antminer S21+ (16.67 W/TH) offers lower capital outlay but higher operating costs per hash. A $6,400 Antminer S21 XP (13.5 W/TH) costs more upfront but produces more Bitcoin per dollar of electricity.

Mining Pools vs Solo Mining

The odds of solo mining a block with a single ASIC sit at about one in several million. A 270 TH/s machine represents roughly 0.00003% of network hashrate. Solo miners face extreme variance. They might mine nothing for years or hit a block tomorrow.

Mining pools solve this variance problem. Pools aggregate hashrate from thousands of miners. When the pool finds a block, rewards distribute in proportion to contributed hashpower. A miner contributing 0.001% of pool hashrate receives 0.001% of each block reward.

Pool payment methods vary. FPPS (Full Pay Per Share) pools pay miners based on expected value regardless of blocks found. The pool absorbs variance risk. PPS+ pools include expected transaction fees. PPLNS (Pay Per Last N Shares) ties payouts to actual blocks found over recent work.

Most individual miners prefer FPPS for predictable daily payouts. This consistency helps cover recurring expenses like electricity without selling accumulated Bitcoin during unfavorable price conditions.

Bitcoin Mining: The Simple Mining Approach

Simple Mining operates professional hosting infrastructure in Cedar Falls, Iowa. The facility runs on a 65% renewable energy mix from regional wind and solar generation. Hosting rates start at $0.08/kWh for smaller deployments and drop to $0.07/kWh for enterprise-scale operations.

The operational model removes friction from mining. Clients own their hardware outright. Simple Mining handles racking and monitoring plus firmware updates and on-site ASIC repairs. The in-house repair center ranks among the largest in North America with Bitmain-certified technicians.

Precision billing charges for exact uptime and nameplate power consumption. ASICs often draw higher wattage than their label suggests. Billing at nameplate rather than at-the-wall consumption results in about 5.5% free electricity for the client.

Risk mitigation features include: 12 months of free repairs on hardware purchased through Simple Mining plus a 90-day warranty on all repair work. Additional protection comes from hashrate replacement programs for persistent underperformers and voluntary pause periods during unprofitable conditions with no billing.

New clients access a 7-day free trial with 100 TH/s of hashrate to test the dashboard and infrastructure before committing capital. This reduces decision risk for first-time mining investors.

Conclusion

Mining converts electricity into Bitcoin at production cost. Understanding how does bitcoin mining work empowers investors to evaluate this asset class on its fundamentals rather than speculation.

Want to see how mining fits your portfolio? Book a consultation with Simple Mining's team for a personalized assessment. Or start your 7-day free trial to watch the dashboard work before you spend a dollar.