Key Takeaways

- Bitcoin transaction fees are payments to miners measured in satoshis per virtual byte (sat/vB), not percentages of the amount sent.

- Fees rise when the mempool is congested and fall when network activity drops.

- Transaction size depends on the number of inputs (UTXOs) and address type, not the dollar value of Bitcoin.

- Consolidate small UTXOs during low-fee periods to avoid "dust" that becomes too expensive to move later.

- Use SegWit addresses, batch sends, and time transactions to minimize costs.

Every Bitcoin transaction carries a fee. This fee goes to miners as an incentive to include your transaction in the next block. The fee you pay determines how fast your transaction confirms. Understanding this system helps you avoid overpaying and prevents your coins from getting stuck in limbo.

What Is a Bitcoin Transaction Fee?

A bitcoin transaction fee is a payment to miners for processing and confirming your transaction on the network.

Think of it as a tip. Miners choose which transactions to include based on the fee attached. Higher fees get priority. Lower fees wait. During busy periods, this tip can mean the difference between a 10-minute confirmation and a multi-day delay.

Fees are measured in satoshis per virtual byte (sat/vB). One bitcoin equals 100,000,000 satoshis. The sat/vB rate tells miners how much you're willing to pay per unit of data your transaction occupies.

How Do Bitcoin Network Fees Work?

Fees create a bidding market where users compete for limited block space by offering miners higher sat/vB rates.

Each block is limited to 4,000,000 weight units, which translates to roughly 1–2 MB of transaction data on average (and up to ~4 MB in cases of high SegWit or Taproot usage). When more people want to transact than the block can fit, a queue forms. This queue is the mempool. Miners sort pending transactions by fee rate and grab the highest-paying ones first.

The result is a real-time auction. When network activity spikes, fees spike with it. When activity drops, fees fall. You can check current fee estimates on sites like mempool.space before broadcasting.

How Does the Mempool Affect Bitcoin Fees?

The mempool is your fee compass. A shallow mempool (few pending transactions) means low fees. A deep, congested mempool means higher bids are required.

Before sending, check the mempool depth. If you see 200+ MB of pending transactions, expect elevated fees. If it's under 10 MB, you can often get away with a lower sat/vB rate and still confirm within a few blocks.

Is the Fee Based on the Amount of BTC Sent?

No. Fees depend on transaction data size in bytes, not the dollar value transferred.

This surprises newcomers. You could send $1,000,000 for the same fee as $10 if both transactions have similar data footprints. Traditional finance charges percentages. Bitcoin charges by weight.

A simple transaction with one input and two outputs might be 140 virtual bytes. A complex transaction consolidating 50 small deposits could be 7,000+ vBytes. The second transaction costs 50x more in fees, regardless of the BTC amount inside.

How to Calculate Your Bitcoin Transaction Fee

Multiply your transaction size in virtual bytes by the current sat/vB rate to get the total fee.

Formula: Transaction Size (vB) × Fee Rate (sat/vB) = Total Fee (sats)

Example:

- Transaction size: 250 vB (typical for a simple send)

- Current medium-priority rate: 20 sat/vB

- Total fee: 250 × 20 = 5,000 sats

At a $100,000 BTC price, 5,000 sats equals $5. At $50,000 BTC, it's $2.50. The sat/vB rate stays the same; the dollar cost moves with Bitcoin's price.

| Priority Level | Typical sat/vB Range | Confirmation Target |

|---|---|---|

| Low | 1–10 sat/vB | Hours to days |

| Medium | 10–30 sat/vB | 30 min – 2 hours |

| High | 30–100+ sat/vB | Next 1–3 blocks |

Rates vary with network conditions.

Most wallets estimate fees for you. Trust the estimate for routine sends. For large or time-sensitive transfers, verify against a live fee estimator.

What Makes a Transaction Take Up More Bytes?

The number of inputs (UTXOs), outputs, and address type determine transaction size.

Every time you receive Bitcoin, your wallet stores it as an Unspent Transaction Output (UTXO). When you spend, your wallet combines UTXOs as inputs to cover the amount. Each input adds roughly 68 vBytes (SegWit) or more (legacy).

What increases size:

- More inputs: Consolidating 20 small deposits creates a heavier transaction than spending one large UTXO.

- Legacy addresses: Addresses starting with "1" use more space than SegWit addresses starting with "bc1."

- Multiple outputs: Sending to several recipients in one transaction adds data.

Operator reality: We see this constantly in client wallets. Mining payouts arrive daily as small UTXOs. Over a year, a wallet might hold 300+ tiny UTXOs. When the holder tries to move their stack, the fee quote shocks them. The solution is proactive consolidation.

How Can I Lower My Bitcoin Transaction Fees?

Consolidate small UTXOs during low-fee periods, use SegWit addresses, and time transactions to avoid congestion spikes.

Three tactics:

- Use SegWit or Native SegWit addresses. Addresses starting with 'bc1q' (Native SegWit) or 'bc1p' (Taproot) produce smaller, more efficient transactions than legacy '1' addresses. Smaller transactions cost less.

- Batch transactions. If you send to multiple recipients, combine them into one transaction instead of three separate ones.

- Time it right. Fees drop on weekends and late nights (UTC). Avoid sending during major network events like halvings or inscription surges.

For a deeper breakdown of miner economics, see What Is Hashprice.

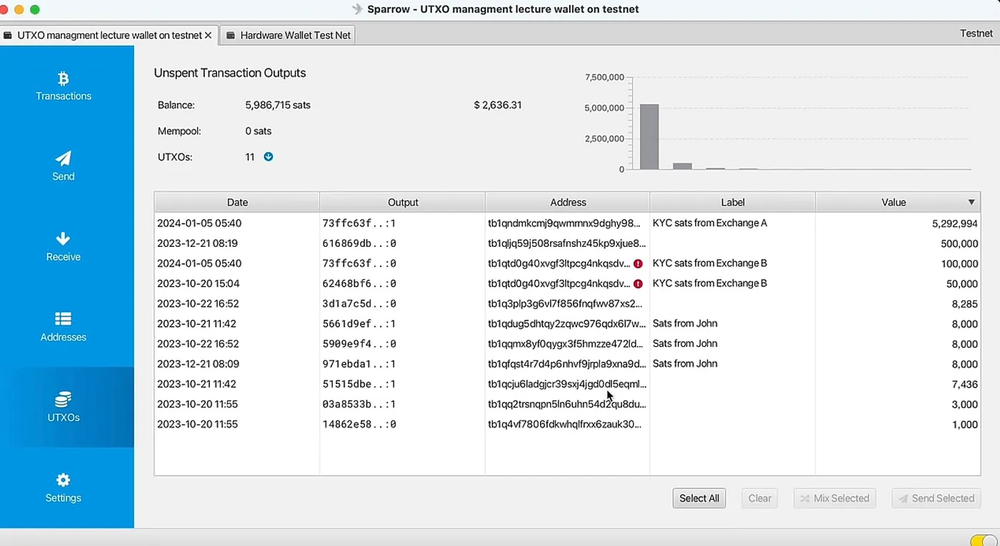

How to Consolidate Bitcoin UTXOs

UTXO consolidation means combining many small UTXOs into fewer large ones so future transactions stay cheap.

When to consolidate: During low-fee windows (under 5 sat/vB is ideal). Check the mempool first.

How to do it:

- Open a UTXO-aware wallet like Sparrow Wallet.

- Select all small UTXOs you want to merge.

- Send them to your own receive address.

- Pay the one-time fee now to avoid paying 10x later.

What can go wrong: If you consolidate during a fee spike, you defeat the purpose. If you wait too long, your small UTXOs could become economically unspendable ("dust"). A 1,000-sat UTXO is worthless if moving it costs 2,000 sats.

Mitigation: Set a calendar reminder to check fees monthly. Consolidate when rates dip below your threshold.

The Future of Bitcoin Transaction Fees

Transaction fees will become a larger share of miner revenue as block subsidies continue to halve.

Every four years, the Bitcoin protocol cuts the block reward in half. The 2024 halving saw the subsidy drop to 3.125 BTC per block. We are now well into this epoch, and the network is increasingly preparing for the 2028 halving, which will further shift miner reliance toward the fee market. By 2140, the subsidy hits zero. At that point, transaction fees become the sole incentive for miners to secure the network.

Where fees stand today: Fees currently make up less than 5% of miner revenue during normal conditions. Bull markets push that figure to around 15%. History shows how volatile this can be; during the 2024 halving, protocols like Ordinals and Runes spiked fees to over 90% of block revenue (notably on block 840,000). These spikes aren't just anomalies; they are a preview of a 'post-subsidy' world where network security is funded entirely by user demand for block space.

Will the mempool ever clear? Unlikely. There will always be demand for on-chain settlement because it provides complete and immutable finality. Even during low-fee periods, the mempool holds pending transactions. Lower fees signal decreased urgency, not dried-up demand.

What about Lightning? Layer 2 solutions like the Lightning Network move everyday payments off-chain. A common concern is that Lightning could cannibalize miner revenue by pulling transactions away from the base layer. The data suggests otherwise.

Lightning requires on-chain transactions to function. Every channel open and channel close is an on-chain multi-sig transaction. More Lightning adoption means more channel activity, which means more on-chain transactions and more fees for miners. Lightning scales Bitcoin as a medium of exchange without gutting the fee market.

The long view for miners: As subsidy declines, efficient operations with low power costs and high uptime will capture fee revenue that marginal miners cannot. Miners may also diversify into demand response agreements and high-performance computing arrangements. The operations that survive will be the ones that treat fees as core revenue rather than bonus income.

What this means for UTXO holders: Consolidate now while fees remain manageable. A 10,000-sat UTXO is spendable today at 5 sat/vB. If fees average 500 sat/vB in a future bull run, that same UTXO costs more to move than it holds. The fee market rewards those who plan ahead.

FAQ

Why is my Bitcoin transaction taking so long?

Your transaction is stuck because the fee you paid is lower than what miners currently prioritize. Check the mempool. If congestion is high, your low-fee transaction waits until demand subsides or you use Replace-By-Fee (RBF) to bump it.

What happens if I underpay my Bitcoin fee?

The transaction stays unconfirmed in the mempool. It will either confirm when congestion clears or drop from mempools after roughly two weeks. If your wallet supports RBF, you can broadcast a replacement with a higher fee.

Can I send Bitcoin with zero fees?

Technically yes, but miners will likely ignore it. Zero-fee transactions sit indefinitely unless a miner voluntarily includes them. For practical purposes, always attach at least a minimal fee.

Conclusion

Transaction fees are a market signal. They tell you how much demand exists for Bitcoin's limited block space. For holders, the lesson is consolidation before fees spike. For miners, fees are revenue.

Ready to run your own mining operation without managing the complexity? Explore Simple Mining's hosted mining solutions and start earning Bitcoin at institutional-grade facilities.