Key Takeaways

- A Bitcoin mining rig is an ASIC machine that converts electricity into BTC through proof-of-work computation

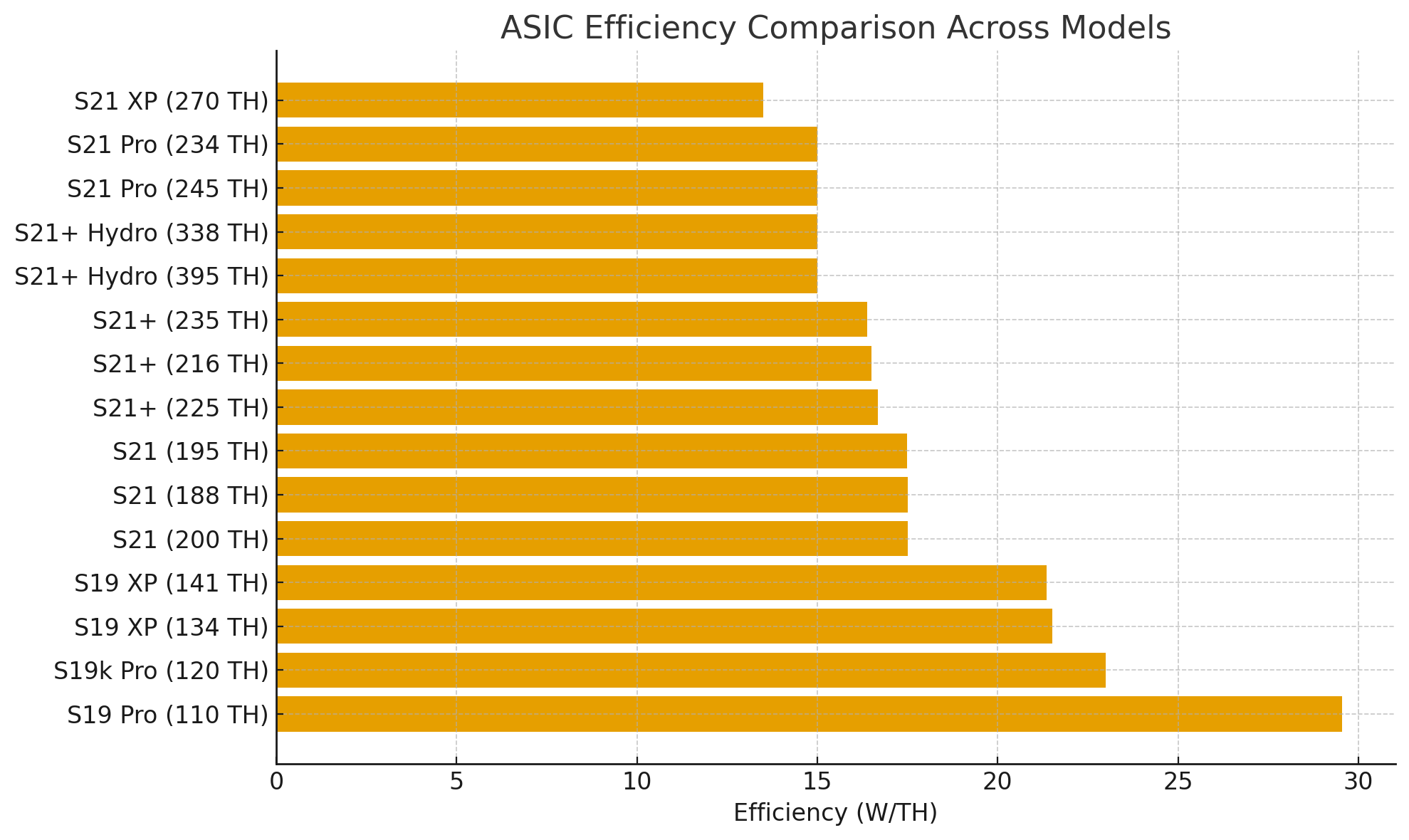

- Current hardware costs approximately $4,000 to $12,000 with efficiency ranging from 13.5 to 17 W/TH as of November 2025

- ROI depends on hashprice dynamics: mining may outperform when Bitcoin price grows faster than network hashrate, but no guarantees exist

- 100% bonus depreciation may create tax advantages unavailable through spot BTC or ETF purchases (consult a tax professional)

- Buying hardware during miner capitulation (low hashprice) may maximize potential upside from both hardware appreciation and mining profits

A bitcoin mining rig converts electricity into Bitcoin. The economics work when your cost to produce one bitcoin falls below the market price. For investors seeking exposure beyond spot purchases or ETFs, mining may offer a potential path to acquire BTC at a discount under favorable market conditions while generating possible tax advantages unavailable through other methods. The catch: you must understand both the upfront hardware costs and the ongoing operational expenses that determine your return. No outcome is guaranteed, and profitability depends on volatile market conditions.

What Is a Bitcoin Mining Rig?

A bitcoin mining rig is a specialized computer built to solve cryptographic puzzles on the Bitcoin network. Think of it as a machine that guesses lottery numbers billions of times per second. The network rewards successful guesses with newly minted bitcoin.

Modern rigs use Application-Specific Integrated Circuits (ASICs). These chips perform one task: executing the SHA-256 hash algorithm that secures Bitcoin's proof-of-work consensus. Unlike general-purpose computers, ASICs cannot browse the web or run spreadsheets. They mine bitcoin and nothing else.

The key metric for any bitcoin mining rig is efficiency, measured in Watts per Terahash (W/TH). Lower numbers mean the machine produces more hashes for each watt consumed. A 13.5 W/TH machine costs less to run than a 21 W/TH machine producing the same output.

How Bitcoin Mining Rig Costs Break Down

Mining economics split into two categories: capital expenditure (CAPEX) for hardware and operational expenditure (OPEX) for electricity and hosting.

Step 1: Hardware Purchase (CAPEX)

Current-generation ASICs range from approximately $4,000 to $12,000 as of November 2025, depending on model and market conditions. The Antminer S21 XP at 270 TH/s and 13.5 W/TH efficiency costs around $6,395 (check current prices). High-end S21+ Hydro models in the high-300 TH/s range can run around $11,000 (prices vary). Older models like the S19 series trade for less but consume more power per hash.

Step 2: Hosting or Infrastructure

Running miners at home requires 220V electrical circuits and industrial cooling. Most investors choose hosted mining instead. Professional facilities typically charge $0.06 to $0.08 per kWh all-in. This covers electricity, cooling, security, and basic maintenance. In the examples below, we use $0.08/kWh as a base case for all-in hosting and note where cheaper power would improve the numbers.

Step 3: Ongoing Operational Costs

Electricity represents 70% to 90% of operational expenses. A 3,645W miner running 24/7 consumes about 2,624 kWh monthly. At $0.08/kWh, that costs $210 per month. Pool fees add another 0.5% to 2% of mined revenue.

Step 4: Calculate Daily Revenue

Revenue depends on hashprice, the dollar value earned per terahash per day. Under current conditions as of late November 2025, a 270 TH/s Antminer S21-class rig generates roughly $10 per day in gross mining revenue. At a $0.08/kWh all-in power rate, that works out to low single-digit dollars per day in estimated net profit. Both figures move with BTC price, network difficulty, fees, and uptime.

Step 5: Determine Payback Period

Divide total CAPEX by monthly profit. For example, based on Simple Mining's tools as of late November 2025, a roughly $6,400 Antminer S21 XP (270 TH/s) at a $0.08/kWh all-in power rate might earn on the order of $100 per month in estimated net profit, implying a simple payback time in the neighborhood of five to six years. Actual results vary with BTC price, network difficulty, uptime, and fees. Price increases can compress this timeline; downturns extend it.

Why Investors Care About Bitcoin Mining Rig ROI

Mining creates optionality that spot purchases cannot replicate. When Bitcoin price rises, your mining output maintains constant BTC production while operational costs remain fixed in dollars, assuming stable electricity costs and uptime. As a hypothetical example: a $7/day cost that produces $15/day in BTC becomes attractive when price doubles. The miner still costs $7/day but now produces $30/day in BTC value. Past performance does not guarantee future results.

This asymmetry matters. Hashrate growth requires physical infrastructure: warehouses, transformers, shipping containers of ASICs. Building takes 6 to 12 months. Price can move in minutes. During the 2021 bull run, hashprice saw significant increases while many miners waited on equipment deliveries.

What Can Go Wrong

Network difficulty adjustments erode profitability when hashrate grows faster than price. The April 2024 halving cut block rewards from 6.25 to 3.125 BTC. Some machines that were profitable before the halving became marginal or unprofitable. Older ASICs with poor efficiency face the highest risk. Under today's hashprice, many S19-class machines are at or below break-even even with competitive power, while modern S21-class rigs still show positive margins at $0.08/kWh. That's why efficiency and hardware generation matter as much as headline hashrate.

How to Mitigate

Choose high-efficiency machines (sub-16 W/TH) that survive difficulty increases. Use hosting providers that offer pause periods, letting you power down without penalty when mining turns unprofitable. Lock in low electricity rates before demand spikes.

Why Efficiency Gains Are Slowing Down

A common fear is that a miner bought today will be obsolete in a year or two. That concern made sense in the early days of ASICs, when each new generation could cut power consumption per terahash by 50% or more. Those “giant step” improvements are much harder to achieve now.

Modern rigs like the S21-class sit in the low to mid-teens W/TH. Future generations may still improve efficiency, but the gains are more likely to be incremental. Think roughly 10–20% better, not a 2–3x overnight step-change. Physics, chip design limits, and manufacturing costs all put a natural ceiling on how much more efficiency can be squeezed out.

For someone mining at an all-in power rate around $0.08/kWh, that matters. If you start with a top-tier efficiency machine today, a future model that is modestly more efficient does not automatically turn your hardware into dead weight. Your rig may slide down the competitiveness ladder over time, but it is not instantly pushed off the map the way older, very inefficient models were when ASICs were new.

This does not remove hardware risk, because ASICs are still depreciating assets, but it does mean that buyers of current-generation, high-efficiency rigs are protected by diminishing returns on efficiency. In practice, power price, uptime, and hashprice often matter as much as squeezing out the last few joules per terahash.

Decision Framework: When to Buy a Bitcoin Mining Rig

This framework is educational and not financial or tax advice. Investors should consult qualified professionals before making decisions.

Timing matters more than most investors realize. The price of ASICs correlates with Bitcoin price. Hypothetically, based on past cycles, an $11,000 machine purchased at cycle tops could drop to low hundreds at the bottom. Buy during miner capitulation and your hardware may appreciate alongside your mined bitcoin.

If hashprice sits near all-time lows: This signals miner distress. Weak operators exit. Hardware prices drop. This may represent an opportunity to deploy capital for potential upside.

If Bitcoin price exceeds your 4-year target growth rate for hashrate: Mining may potentially outperform dollar-cost averaging in scenarios where price grows faster than hashrate, based on historical data, but no guarantees exist. Historical data shows hashrate has grown significantly per halving epoch, often 200% to 500%. If you expect price to exceed that growth rate, mining may offer leverage.

If you need tax advantages: Mining hardware qualifies for 100% bonus depreciation under current U.S. tax law (as of 2025; consult a tax professional). A $150,000 hardware purchase may generate significant immediate tax savings for eligible taxpayers. Spot BTC and ETFs offer no equivalent benefit.

If you want bitcoin accumulation: Hosted mining generates daily bitcoin, allowing accumulation of BTC. However, the USD value is subject to price volatility.

Comparing Alternatives: Mining vs. Spot vs. ETF

These are estimates as of November 2025. Actual costs and benefits vary based on market conditions.

| Method | Upfront Cost | Ongoing Cost | Tax Treatment | BTC Acquisition Cost |

|---|---|---|---|---|

| Bitcoin Mining Rig | $4,000-$12,000 per unit | $0.06-$0.08/kWh | 100% bonus depreciation | Below market when profitable |

| Spot Purchase | Market price | Exchange fees (0.1%-1.5%) | Capital gains only | Market price |

| Bitcoin ETF | Market price + expense ratio | 0.2%-1.5% annual fee | Capital gains only | Market price + fees |

Mining may win when you believe hashprice will expand (price outpaces hashrate). Spot wins for simplicity and liquidity. ETFs suit retirement accounts where custody complexity matters.

The honest assessment: mining involves more variables. Hardware selection, hosting quality, and timing all affect returns. Some investors prefer the certainty of market price over the complexity of operational margins.

The Simple Mining Angle

Simple Mining operates over 20,000 ASICs across facilities in Iowa with a 60% renewable energy mix. The operation exists to remove friction between investors and profitable mining.

On-Site Repairs: Machines go back online in days to weeks versus potentially longer with external services. Downtime destroys returns. Fast repairs protect them.

Precision Billing: Clients pay for actual power consumption, providing fair and precise billing.

7-Day Trial: Test a miner before committing capital. Verify performance against projections. No penalty for walking away.

Pause Periods: Suspend machines during unprofitable conditions without breaking your hosting contract. This feature transforms fixed costs into variable costs during market stress.

Transparent Operations: Real-time dashboards show hashrate, uptime, and earnings.

12 Months Free Repairs: Hardware purchased through Simple Mining includes repair coverage for the first year. This eliminates a major unknown from your ROI calculation.

Conclusion

A bitcoin mining rig turns electricity into hard money. The math works when your all-in production cost falls below market price, but profitability is not guaranteed and depends on market conditions. Success requires efficient hardware, cheap power, and the patience to buy when others capitulate.

Ready to model the numbers for your situation? Book a consultation to get an expert assessment of how mining fits your portfolio and tax picture.