Key Takeaways

- FPPS dominates today because transaction fees were historically small/predictable

- Rising fee volatility makes variance insurance impossible at scale

- Pool operators face a choice: massive fee increases or model innovation.

- Next-generation structures mitigate custodial risks

- This transition improves Bitcoin's decentralization and fee market efficiency

Every 10 minutes, somewhere in the world, a Bitcoin mining pool (mining pools find 99% of blocks) finds a block worth $300k+ (at the time of writing).

But here's what most investors miss:

How this money gets distributed among thousands of miners reveals one of Bitcoin's most overlooked structural aspects.

Why do some pools promise instant, guaranteed payments while others make you wait for actual blocks to be found?

As transaction fees surge toward 50% of block rewards (and beyond), the dominant payout structures used today may become mathematically impossible to sustain.

Pools exist to give miners peace of mind. The uncertainty of variance is the problem pools solve.

Most miners can’t handle the risk of paying for electricity and infrastructure without a guaranteed payment.

Would you rather buy a lottery ticket every day and hope to win, or join a pool of millions of lottery ticket buyers and split the rewards when someone wins?

This is pool mining👆

The way a pool rewards a miner can vary.

How a miner gets paid through a pool can impact profitability and centralization.

This letter breaks down the various payout structures and what they mean for the future of Bitcoin mining.

Pool Payout Methods

Pool payouts are not just "how miners get paid.”

They are risk allocation mechanisms.

99% of mining pools use a version of FPPS.

Full-Pay-Per-Share (FPPS): The pool pays miners a fixed fee for each valid share submitted, regardless of whether a block is found.

The pool estimates the expected value of the block subsidy and the transaction fees.

When calculating this estimate, many FPPS pools will exclude the 3 highest and 3 lowest fee blocks.

This means miners getting paid via FPPS don’t have exposure to the outliers.

This is like the deluxe insurance package, estimating both base salary AND anticipated tips.

Miners demand consistent payouts (FPPS), which shifts the risk from individual miners (hashers) to the pool, which must pay out regardless of how many blocks have been found.

This reminds me of this chart:

FPPS is a major contributor to why mining pools are centralized.

Pay-Per-Last-N-Shares (PPLNS): Miners only get paid when blocks are actually found, with rewards distributed based on their recent share contributions.

No insurance here. This is pure lottery economics where winnings are shared proportionally.

Note that FPPS (insurance pools) need to have deep pockets. In a run of bad luck, they still need to pay the miners.

Here's the key insight most people miss: these aren't just different payout methods. They represent different approaches to who bears the risk of mining's randomness.

Ocean is the main PPLNS pool, and they use a variant of PPLNS called TIDES (Transparent Index of Distinct Extended Shares)

This eliminates reserve requirements entirely because miner rewards are paid out directly from each block.

How It All Started

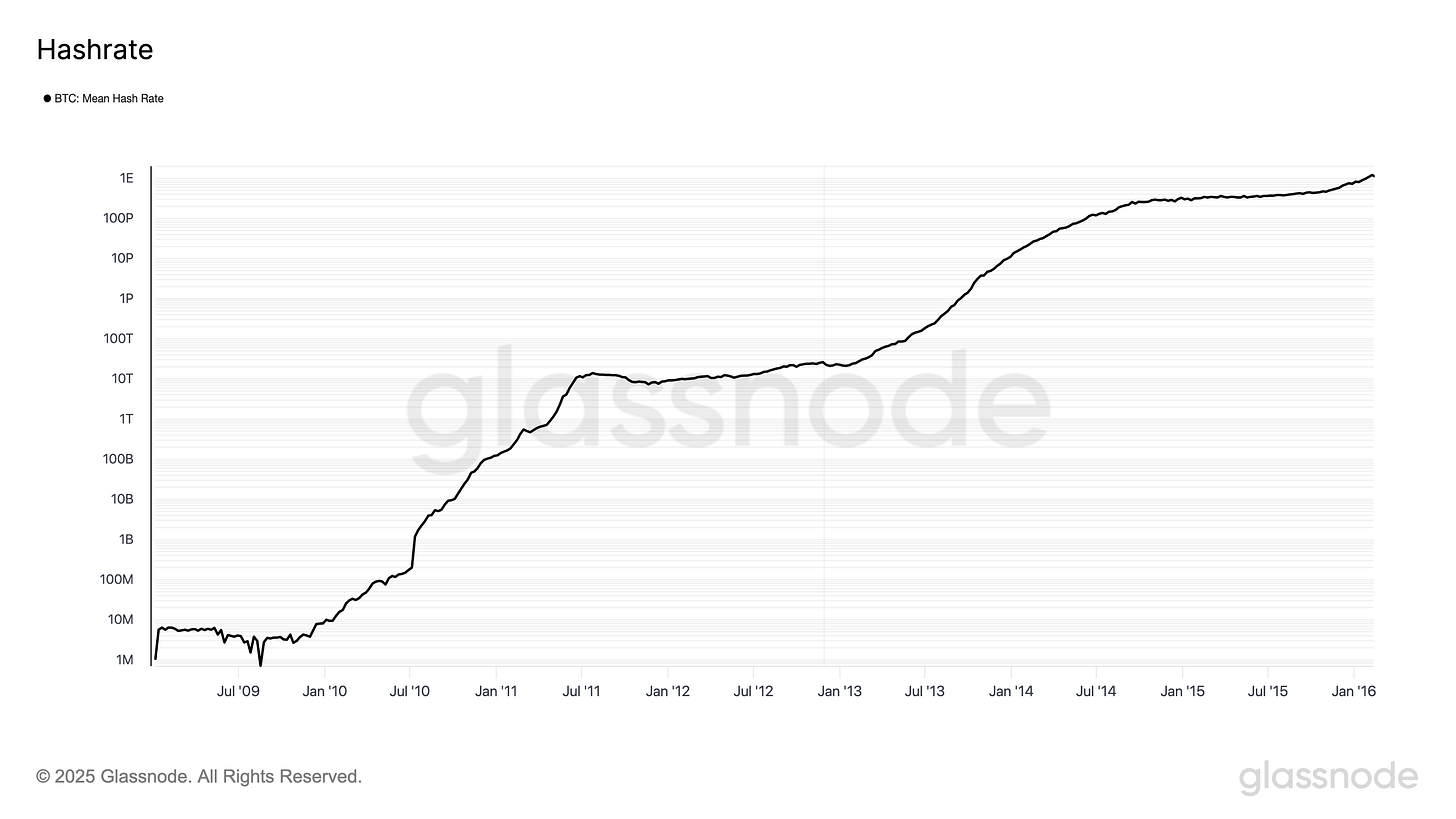

Bitcoin mining pools emerged in 2010 out of mathematical necessity.

Individual miners faced brutal economics: Once hashrate really started to take off in 2010, each miner faced smaller and smaller odds of winning a block.

Current hashrate conditions are a good example:

If you wanted to win 1 block per month (1/4320 odds), you would need roughly 250 PH/s.

This could cost millions of dollars for machines and hundreds of thousands of dollars per month to run the operation.

If you get a bad luck streak for several months, you go bankrupt.

This is why Slushpool launched in 2010.

The early solution was simple: risk-sharing using PPLNS structures.

Instead of each miner finding one block per year (and going bankrupt paying electricity bills in the meantime), the collective would find blocks weekly, splitting rewards proportionally.

Pool luck created some variance, but over time, everything averaged out to mathematical expectations.

But PPLNS still required miners to stomach significant payout volatility.

The Present: The FPPS Insurance Solution

Fast-forward to today's landscape, FPPS dominates Bitcoin mining pools.

Giants like Foundry (30%+ network hashrate), Antpool, ViaBTC, and F2Pool all offering guaranteed payout structures. Why the shift?

Capital intensity exploded. Modern mining operations represent hundreds of millions in deployed capital. These miners are in the business of recouping this deployed capital as fast as possible. If they’re borrowing funds (using leverage), monthly revenue swings can be existential.

Many public miners want one thing: to get paid.

They don’t want to deal with variance, accounting, compliance, mempool management, etc.

This is how FPPS became the industry standard.

But insurance costs money. Current pool fee structures reflect this reality at ~1% of miner revenue.

Here's the hidden cost most miners ignore:

FPPS miners forfeit any revenue related to transaction fee spikes.

Block fee rates have historically seen several spikes into the 75th percentile.

We have seen fees as a % of broad miner revenue clock as high as 75% (April 2024 halving):

When fees explode to a large % of miner revenue, pools pocket the excess while miners get historical averages.

The trade-off seemed reasonable when transaction fees were small and predictable. That's about to change dramatically.

The Crisis Brewing

Let's examine the numbers that will dismantle this system.

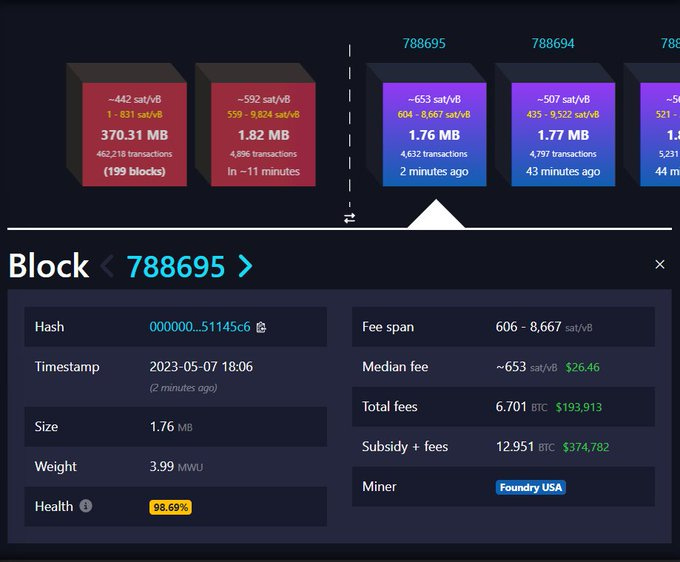

In May 2023, we witnessed a preview:

6.7 BTC transaction fees + 6.25 BTC subsidy.

This was the first time in history transaction fees > block subsidy due to high block space demand.

This wasn't an anomaly, but rather a glimpse of Bitcoin's inevitable future.

Here's the math that terrifies pool operators:

Current state (post-2024 halving):

- Block subsidy: 3.125 BTC

- Average transaction fees: 0.1-0.5 BTC per block (highly variable)

- Fee spikes: Can exceed 2-6 BTC during network congestion

Future projections paint a stark picture:

- 2028 halving: Block subsidy drops to 1.5625 BTC

- 2032 halving: Block subsidy falls to 0.78125 BTC

- Fee percentage: Will inevitably become 50%, 70%, even 90% of total rewards

The variance explosion becomes clear:

Transaction fees will represent a bigger percentage of the total payout to miners.

This will increase the variance/uncertainty of payouts , which will perpetually increase the insurance costs for FPPS pools.

This analysis reveals the capital requirements: pools need anywhere from $47 million (450 BTC) for 95% survival probability over one year, up to $94 million (900 BTC) for 99% survival over three years.

And that's with TODAY'S relatively stable fee environment.

What happens when fees become the dominant, wildly volatile component of block rewards?

Why FPPS Is Destined For Disruption

Pool operators face an impossible trilemma as fee variance explodes:

- Raise fees dramatically to cover variance insurance (potentially 5-10%+ pool fees)

- Maintain massive BTC reserves (potentially billions in capital requirements, or even worse, Bitmain becomes the Federal Reserve of Bitcoin mining pools)

- Exit FPPS entirely and abandon the insurance model

Option 1 makes pools uncompetitive. Option 2 is somewhat of the current situation, but miners are waking up to this. Option 3 seems inevitable.

The feedback loop accelerates the collapse:

Higher FPPS fees make PPLNS pools more attractive → hashrate migrates → remaining FPPS pools need even larger reserves per unit of hashrate → fees rise further → more migration occurs.

We're already seeing early experiments in post-FPPS structures:

Ocean Pool's TIDES System: TIDES is a Bitcoin mining pool payout system that reduces payout variance as low as possible without the pool operator needing to hold and buffer the Bitcoin rewards as a custodian.

This non-custodial PPLNS variant eliminates reserve requirements entirely while maintaining low variance through an 8-block window system.

NiceHash's RTPPS Model: The Real-Time Pay-Per-Share (RTPPS) system, introduced by NiceHash in 2014, allows miners to earn in real time based on the spot price of hashrate. Unlike traditional pay-per-share models, RTPPS calculates the price of shares every minute, driven by buyer demand for hashrate.

This marketplace approach separates hashrate provision from block finding.

Concepts like this are key to making Bitcoin mining *more decentralized.*

Miners sell computational power to buyers who direct it toward specific tasks and applications.

During high-demand periods, this price can surpass traditional payout rates, enabling miners to earn a premium.

In a perfect world, each block reward is fairly distributed to each miner according to their proportion of work in a certain window, with no middleman.

I think Bitcoin can achieve a compartmentalized version of this without a software fork.

Macro Forces Accelerating Change

Several broader trends make this transition inevitable:

Energy Market Integration: More risk management tools will become available as more players get involved, i.e., energy companies. Sophisticated miners increasingly prefer transparent risk pricing over opaque pool insurance.

Mining Consolidation: Larger operations have sufficient scale to handle variance without pool insurance, making FPPS less attractive to the most influential participants.

Capital Market Evolution: Mining companies are developing direct hedging instruments, reducing dependence on pool-level variance smoothing.

Investment Implications

For mining investors, think about these critical concepts:

- Fee-to-subsidy ratio: When fees consistently exceed 25% of total block rewards, how will miners pivot their hashing?

- Pool reserve adequacy: Major pools disclosed BTC holdings relative to their hashrate requirements.

- Fee structure changes: Rising FPPS fees (above 1-2%) signal impending model breakdown.

- Payout migration trends: Growth in PPLNS adoption may indicate disruption.

Strategic positions to consider:

- Pools developing sustainable, non-custodial payout structures

- Companies building variance hedging products for the mining industry

- Bitcoin infrastructure plays that benefit from mining decentralization

Conclusion

As a client of Simple Mining, we allow investors to choose any Bitcoin mining pool.

We are partnered with both the above pools: Ocean and NiceHash

There are unique benefits to each, and we help match investors with the best solution.

The current FPPS-dominated landscape is a temporary historical artifact of Bitcoin's low-fee era.

Smart money is already positioning for the new pool payouts era:

The return to risk-sharing models, but equipped with sophisticated new tools for variance management, non-custodial implementations, and transparent risk allocation.

In mining, predictability commands a premium, but uncertainty costs everything.